Revology Analytics Insider

Browse Contents Based on Category or Topic

Filter by Category

Filter by Topic/Tag

- AI

- AI Pricing

- AI in Business Analytics

- AI/ML

- AI/ML Distribution

- Analysis with Python

- Analysis with R

- Analysis with Tableau

- Analytics Leadership

- Attribution Modeling

- Bayesian Modeling

- Budget Optimization

- Business Growth through Pricing

- CPG

- CRM Data Analysis

- Commercial Analytics Transformation

- Competitive Analysis

- Competitive Pricing

- Consumer Durables

- Consumer Products

- Cross-Sell Optimization

- Customer Analytics

- Customer Churn Modeling

- Customer Retention

- Customer Segmentation

- Data Visualization

- Data Warehouse

- Data-Driven Decision Making

- Data-driven Pricing

- Discount Management

- Distribution

- Durable Goods

- Dynamic Pricing

- Elasticity-Based Pricing Strategies

- Forecasting

- Growth Drivers Analysis

- HiPPO effect

- In-sourced Pricing

- Industrial Manufacturing

- Industry Margin Pools

- Inventory

- Inventory Waste

- Knowledge Graphs

- Machine Learning

- Manufacturing

- Margin Analytics

- Margin Erosion Prevention

- Margin Optimization

- Marketing Analytics

- Marketing Effectiveness & Optimization

Subscribe to Revology Analytics Insider

Want to stay abreast of the latest Revenue Growth Analytics thought leadership by Revology?

Accelerating your Commercial Analytics Workstreams with ChatGPT

GPT-4 is already starting to reshape the field of commercial analytics, and we at Revology Analytics are huge proponents of it.

In our recent webinar titled "GPT-Powered Speed: Supercharging your Revenue Analytics," we delved deep into how GPT-4 is a game changer for analytics teams. More specifically, we explored GPT-4's ability to accelerate productivity around diagnostic and predictive analytics for Revenue growth problems.

In addition to exploring how to create the perfect prompts for analytical workstreams, we provided hands-on examples in Python using simulated data sets for things like Price Elasticity modeling, Cohort Analyses, and Churn Modeling.

We have the full recording available here for those who missed the live session or wished to revisit the insights.

How To Manage Your Marketing Budget For Improved ROI

This article was originally published in Authority Magazine’s “The CMO” newsletter.

******

With the growing complexity of marketing channels and the need for businesses to constantly adapt their strategies, managing marketing budgets effectively has become more critical than ever. In this interview series, we speak with CMOs and other marketing leaders who have significant experience in budget management and optimization, to share their “5 Ways To Manage Your Marketing Budget For Improved ROI.” As a part of this series, we had the pleasure of interviewing Armin Kakas.

Demistifying Marketing Mix Modeling

In our popular webinar on Marketing Mix Modeling (MMM), we disdcuss the pros/cons of MMM, and its growing importance in today's privacy-centric, cookie-less world.

We also deep-dive into Meta's innovative MMM framework, Robyn, highlighting how it has revolutionized marketing analytics with its cost-efficiency, granularity of insights, and flexibility.

Our detailed presentation and recorded webinar offer practical demonstrations of Robyn's capabilities, providing a holistic view of channel effectiveness, adstock decay rates, and marketing budget optimization.

The era of six-figure marketing analytics is a thing of the past - welcome to a future of accessible, affordable, and robust marketing effectiveness measurement.

The Merits of Aggregated Data for Demand and Price Elasticity Modeling

It's time to rethink traditional sales and price elasticity modeling methods.

Aggregated data at the retail chain level and modern machine learning models are vital in shaping an efficient, practical, and robust approach for predicting and explaining retail sales.

Why this shift? The traditional reliance on granular, disaggregated (i.e., store-product-day level) data and old-school models are costly, complex, and often misaligned with practical management strategies.

Turning to aggregated data and modern ML approaches reduces costs, enhances model accuracy and efficiency, and makes these valuable insights more accessible to smaller firms and faster for larger ones.

Moreover, in-sourcing these capabilities builds critical, sustainable expertise for Revenue Growth Management, freeing companies from reliance on 3rd parties. This shift signifies an effective and sustainable future for Revenue Analytics and redefines competitive positioning, enabling superior service and product offerings.

Optimizing Medical Device Gross Profits with Dynamic B2B Margin Analytics Platform

Discover how Revology Analytics collaborated with a leading med-tech company to develop a dynamic Margin Analytics platform to enhance pricing and discounting capabilities and promote a stronger margin management discipline.

This case study illustrates the effectiveness of our Outcome-Based Analytics framework combined with targeted Revenue Growth Analytics expertise. Our highly collaborative approach involving internal Core Teams and Sales Team power users ensured the co-creation and sustainable adoption of the Margin Analytics and Optimization capability.

Read more about our detailed approach, with examples of a B2B Marging Analytics dashboard built using simulated data.

Unveiling Your Revenue Growth Analytics Maturity: Unlock Your Full Profit Potential

Discover the power of Revenue Growth Analytics with our newly launched Maturity Scorecard, designed to assess your organization's capabilities in Margin Analytics & Optimization, Sales & Customer Growth Analytics, and Promotion Effectiveness & Optimization.

Take the 3-minute assessment and gain access to tailored recommendations for improvement, as well as an extensive library of free Revenue Growth Analytics resources, including Tableau dashboards and price elasticity models in R and Python. Don't miss out on this opportunity to elevate your Revenue Analytics capabilities and drive significant business impact.

A Brief Guide to Price Elasticity Modeling - Part 2

Understanding the impact of price changes and promotional investments on business outcomes is crucial for all commercial teams (revenue management, finance, analytics, sales, and marketing). In today's data-driven world, it is essential to have a deep understanding of price and promotional elasticities at the customer-product level to optimize sales, profitability, and market share.

The below guide gives an overview of the typical modeling approaches for price elasticities and contrasts regression vs. machine learning methods for industry best practices.

RA Quick Insights Video Series: Revenue Growth Drivers Analysis Tutorial

In this video, the Revenue Growth Drivers Analysis technique is explored in detail for a fictitious company, Company ABC, to understand the drivers of year-over-year net revenue growth.

The analysis breaks down the impact of Pricing actions, Volume, and Customer and Product mix on the company's Net Revenue growth. The detailed analysis is conducted at the customer-product level rather than an aggregate level, allowing for more actionable insights.

We illustrate the detailed calculations for Pricing, Volume, and Mix impacts using an Excel Growth Drivers Analysis template, available for download at https://www.revologyanalytics.com/revenue-analytics-tools.

RFM Analysis as an Important Revenue Growth Analytics Capability - Part 2

RFM Analysis is a powerful tool for businesses seeking insights into customer behavior and segmenting them based on purchasing habits. By calculating RFM scores and creating segments, companies can identify valuable customer groups and target them with personalized sales and marketing campaigns. RFM Analysis is not limited to the retail industry or the marketing domain. It can be applied to most industries and functional domains that touch the customer, including pricing, supply chain, A/R, product management, and customer service. Additionally, RFM Analysis can benefit nonprofit organizations by understanding donor behavior to optimize fundraising initiatives.

In part 2 of our RFM Analysis article, we'll dive deeper into how we can calculate RFM scores, visualize customer performance by RFM segment and discuss sales and marketing implications.

Beyond the Hype: Practical Revenue Growth Analytics Use Cases that Drive Impact

AI/ML is not the ultimate solution for every data-related problem. We must first set up foundational descriptive and diagnostic analytics capabilities and more straightforward ML approaches before applying more advanced techniques. It's essential to understand the business problems and work closely with functional partners to solve them in a way that aligns well with the company's analytical readiness and operating rhythm.

The examples of Revenue Growth Analytics use cases mentioned, such as Promotional Analytics, Everyday Price Optimization, Dynamic, Automated Clearance Pricing, Bulk Purchase Optimization, Customer Segmentation & Predictive Insights, and Customer Churn & Cross-Sell Modeling, are practical and impactful capabilities that can drive measurable sales and gross profit improvements. They can be implemented using simple math and essential ML and with popular tech stacks with which pricing, supply chain, and sales partners are familiar.

Overall, the focus should be on pragmatic and co-created approaches with business stakeholders that are most likely to get adoption and impact rather than on celebrating complexity for its own sake.

RA Quick Insights Video Series: Driving rapid margin actions with transactional data analysis (Part III. - Gross Profit Growth Deep Dive)

Companies are in the business of making money, and most often, they care about maximizing their Revenues, Gross Profit, and Operating Income. One of the biggest challenges Finance and Revenue Management teams face is the ability to systematically diagnose the drivers of fundamental business performance changes near real-time.

The price-cost-volume-mix analysis, sometimes known as Revenue or Gross Profit Growth Deep Dive, helps you understand the relevant components that drove your revenue, gross Profit, or other critical financial changes from one period to the next (or for actuals vs. budget).

This short video will show you a simple Gross Profit Growth Deep Dive built on customer transactional data.

RA Quick Insights Video Series: Driving rapid margin actions with transactional data analysis (Part II. - Discount Curve Analysis)

This week, I wanted to show you another simple yet effective revenue analytics technique to steer sales behavior in the right direction and drive Gross Profits. Part 2: Discount Curve Analysis

RFM Analysis as an Important Revenue Growth Analytics Capability - Part 1

Revenue Growth Analytics (RGA) is a foundational enabler for organizations looking to transform their Revenue Growth Management strategies. RGA goes beyond traditional pricing techniques and provides insights into areas such as customer mix management, customer retention and cross-sell opportunities, and customer lifetime value. One of the key techniques used in RGA is RFM (Recency-Frequency-Monetary) Analysis.

RFM Analysis is a simple yet effective method of analyzing customer transactional data to drive better customer insights and improve customer retention, profits, and customer satisfaction.

Unlocking the Power of Revenue Growth Analytics for Sustainable Growth

The article discusses the common issue faced by Analytics/Data Science COEs where they invest heavily in new initiatives but struggle to see adoption and measurable outcomes. I advise new leaders in the field, data practitioners, and CXOs to focus on fewer initiatives that directly impact the revenue and gross profit drivers of the business, prioritize a subset with the right balance of impact, effort, and support, and involve an internal team of experts from relevant functions in the development process. Additionally, I advocate focusing on specific areas, such as price optimization, customer churn reduction, cross-sell optimization, promotion and discount optimization, and procurement optimization, to generate substantial value and internal adoption in the first couple of years before tackling larger-scale digital transformation type efforts.

If you need to use Machine Learning, keep it simple!

It often amuses me that in the era of ChatGPT (and despite the countless books I have in my library on AI/ML), I've never used any Deep Learning model for any of my client engagements or prior advanced analytics leadership roles.

For 99.95% of data problems in traditional (non-tech) companies, Deep Learning (and any of its derivations like LSTMs, GANs, CNNs, etc.) are overkill at best and a complete waste of time (or not applicable) at worst.

The Business Analyst of Tomorrow

Data science is an ever-evolving field, and its roles are also changing. As businesses increasingly rely on data to inform their decisions, there is a growing need for people with both the technical skills and domain/industry expertise to drive measurable value.

Business Deep Dive Framework for Consumer Goods companies

Analytical fire drills and knee-jerk pricing actions are becoming increasingly common in the consumer goods industry. With intense competition and ever-changing customer needs, companies must be agile enough to rapidly adjust their strategies to remain competitive and deliver relative value to their consumers.

By creating a dynamic integrated performance deep dive, CPGs can identify specific areas of improvement to maximize efficiency while delivering high-quality products at competitive prices — all of which will help them stay ahead of the competition in today's market.

In the below quick guide, we'll explore the steps needed to build a reproducible and highly actionable (and impactful) performance deep dive that can help CPGs address Revenue performance shortfalls.

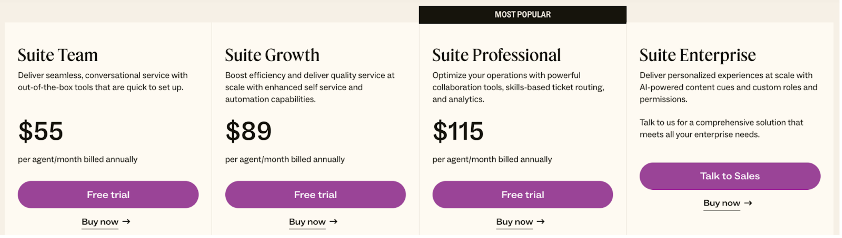

Driving Net Sales and GP$ with Price Testing: A 5-minute guide for Retailers and Distributors

It's no secret that many retailers and distributors are struggling with suboptimal prices, leading to substantial profit losses or missed revenues.

But by developing a solid price-testing playbook, retailers and distributors can maximize profits without sacrificing sales.

You don't need to spend 12-18 months deploying an enterprise price optimization solution or waste a ton of CAPEX. You can start building your own semi-automated price-testing solution today at a fraction of the development times and costs.

If you're a Pricing or Finance executive looking for a way to improve your company's bottom line, read this 5-minute guide on how to build a sustainable Price Testing playbook.

(All I want for Christmas is) better discounting habits!

A brief guide for Manufacturers and Distributors to boost profits by 5-10% using simple, effective pricing and analytics techniques.

If you're a manufacturer or distributor, you know that discounting is vital to the success of your sales force. But are you discounting enough? Are you discounting too much?

This article will discuss the importance of discounting in B2B settings and how to determine the right discounts for your customers and products. We'll also discuss when to use each type of discount and offer tips for increasing Net Revenue and Gross Profit with analytics and surgical discounting.

RA Quick Insights: Top Pricing Quick Wins for Distributors

Below are my top Revenue Growth Analytics quick wins that Distributors should implement (or right-size) to boost gross profits $ by 5-20% and increase liquidity.