Contrasting Regression vs. Machine Learning based approaches

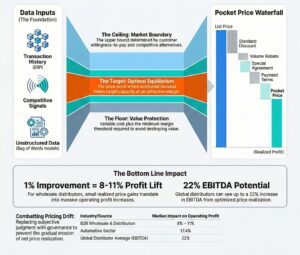

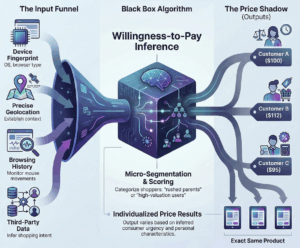

Understanding the impact of price changes and promotional investments on business outcomes is crucial for all commercial teams (revenue management, finance, analytics, sales, and marketing). In today’s data-driven world, it is essential to have a deep understanding of price and promotional elasticities at the customer-product level to optimize sales, profitability, and market share.

Many businesses face the challenges of excessive promotions and discounts, ill-advised indexing strategies to competitor prices, and deploying pricing tactics that lead to declining operating profits and lower margins. Estimating price elasticities through demand models can help address these challenges by identifying the optimal price and promotional investment ranges for a given product and customer segment.

In this regard, we recommend the following five rules to ensure that the demand model is robust and the estimated price elasticities are accurate:

-

Collaborate with internal experts to build and vet the model with cross-functional leaders in sales, marketing, supply chain, and finance.

-

Choose simplicity over sophistication when selecting the best approach to estimate price elasticity. There are times and places for using advanced machine learning techniques over traditional regression methods, and this decision should be made based on the specific business problem at hand.

-

Pay attention to outliers in the data and perform exploratory analysis and summary statistics to understand the variance in the data. Normalize the data or exclude gross outliers if necessary to ensure the accuracy and stability of your demand model.

-

Consider multi-collinearity, as price and other variables are often highly correlated in most demand models. Use regularization techniques or tree-based ensemble models such as Random Forest or Gradient Boosting to handle multi-collinearity.

-

Test the effectiveness of the demand model by comparing new in-market results with the model’s predictions to ensure that the demand model and price elasticities remain accurate against previously unseen sales results.

The below guide expands on our previous article on the “Science (and Art) of Estimating Price Elasticities” and gives an overview of the typical modeling approaches for price elasticities and contrasts regression vs. machine learning methods for industry best practices.

If you have trouble viewing the presentation player below, you can also access the guide here.