The Rising Tide of Tariffs and the Imperative for Strategic Pricing

As 1Q 2025 started off, tariffs have become a significant challenge for businesses of all sizes, and have been the central topic among Pricing and Finance professionals. With escalating rates — some jumping from 4% into the 10% to 25% range — companies are facing immediate and substantial increases in their cost structures. This leaves finance and commercial leaders at a crossroads: Ignore tariffs and potentially watch margins erode, or respond strategically to maintain profitability, and (hopefully) market share.

Yet, tariffs are more than a simple surcharge on raw materials. They can disrupt entire value chains, from components and sub-assemblies to packaging and logistics. The urgency is amplified by the fact that tariffs can “come and go almost overnight,” causing long-lasting ripple effects on both costs, prices and customer perceptions.

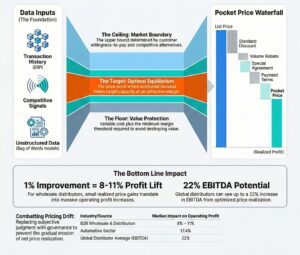

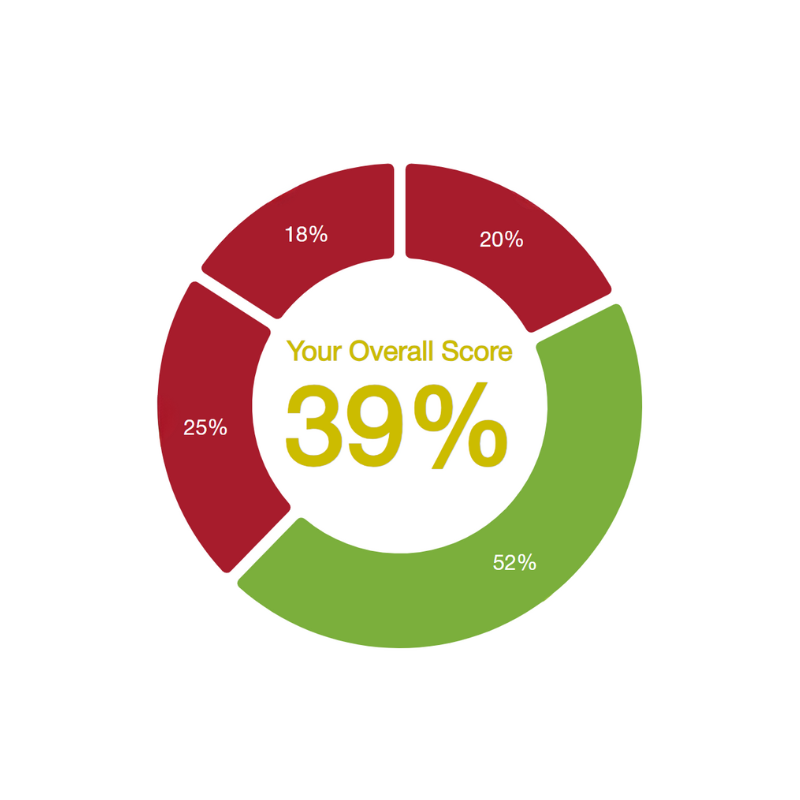

Meanwhile, a Revenue Growth Analytics Maturity Study of 150 commercial leaders by Revology Analytics further underscores this challenge. Over 50% of participating companies ranked only Low or Medium in overall Revenue Growth Analytics maturity—indicating large gaps in strategic and analytical capabilities. Even more telling, only 1 in 10 organizations reported consistently using predictive and diagnostic analytics in their pricing decisions, and nearly one-third measure Net Price Realization just annually (or less). Such findings echo the broader trend of overemphasis on day-to-day pricing “firefighting” at the expense of deeper, long-term strategy and data-driven insights—an imbalance that becomes particularly risky when new tariffs introduce sudden volatility into costs and competitive dynamics.

This article provides a comprehensive framework for identifying tariff vulnerabilities, implementing data-driven pricing strategies, and leveraging Revenue Growth Management (RGM) frameworks. By combining rigorous analysis with modern scenario-modeling capabilities—like those available through Revology Analytics—organizations can protect margins while continuing to deliver strong value to their customers.

Phase 1: Fully Understand the Scope and Depth of Tariff Impact

Before adjusting any prices, it’s crucial to perform a deep dive into the entire value chain. A superficial approach—simply maintaining your gross margin pct on the new, increased costs—is often a misguided strategy that can result in long-term volume and eventually profit dilution. Here’s how to avoid that pitfall:

1. Analyze Your Cost Components

-

Beyond the Headline Rate

Don’t just apply a blanket tariff percentage. Break down your product or service into its core elements: raw materials, sub-assemblies, components, packaging, and any tariff-linked transportation. Even minor parts or “hidden” fees can add up. -

Hidden Costs

Tariffs can trigger indirect price hikes in the supply chain. A component supplier might raise prices simply because they anticipate higher demand or wish to recoup their own increased costs. Be alert for secondary and tertiary impacts. -

Currency Fluctuations

Tariffs can affect exchange rates. If you pay overseas suppliers in a foreign currency and your domestic currency weakens, your effective costs go up even further. Monitoring exchange rate forecasts—or using hedging strategies—is an important piece of the puzzle. -

Administrative Overhead

Complying with new tariff regulations often means additional paperwork, brokerage fees, legal consultations, or specialized personnel. Factor in these administrative expenses to see the true cost impact.

2. Map Your Supply Chain to Spot Vulnerabilities

-

Visualizing the Flow

Create a detailed map of your end-to-end supply chain, from raw material origin to final delivery. Look for any and all points where tariffs may increase costs. -

Supplier Dependency

If you depend heavily on a single supplier in a tariff-impacted region, you’re more vulnerable to sudden price increases. Diversifying suppliers—or at least initiating negotiations—can mitigate this risk. -

Alternative Sourcing Evaluation

Explore new sourcing options before adjusting your prices. Having alternatives increases your negotiating leverage and provides a fallback if existing suppliers become too costly. -

Inventory Management

Holding extra pre-tariff inventory can give you a temporary cushion, allowing time to pivot or renegotiate. But don’t overstock; storage costs, handling fees, and the risk of obsolescence may erode liquidity, profits, and in the US, your ability to borrow money to fund future inventory.

CPG Industry Focus

Most recently, tariffs have been particularly disruptive for some Food and Beverage firms relying heavily on Canadian or Mexican imports for raw ingredients like meats, produce, and packaging. According to recent industry reports, many companies must quickly decide whether to absorb or pass on cost hikes—often under tight timelines—since demand for fresh items can’t easily shift. As a result, short-term sourcing strategies (like emergency contracts with regional suppliers) and contingency plans for expedited shipments become critical to maintaining supply continuity and mitigating cost exposure.

3. Scrutinize Your Competitive Landscape to Sharpen Your Edge

-

Competitor Reactions

Are competitors absorbing tariff costs or passing them on? Are they shifting production locations, redesigning products, or renegotiating with their suppliers? Keeping a pulse on competitor moves will help you position your own pricing response effectively. -

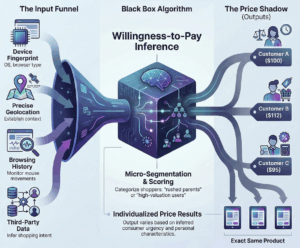

Price Elasticity of Demand

Assess customer price sensitivity, and in particular your customers’ price sensitivity to your changes in competitive price gaps. In highly elastic markets, a small increase could trigger a significant drop in volume. In inelastic segments, you might have more flexibility to raise prices. -

Note: Tariff-driven cost shocks can render existing historical data or elasticity models less reliable, especially if your category has never seen such sudden, large-scale shifts in costs. This means you may need fresh indicators, use other industry post-mortem proxies, or deploy quick customer surveys to gauge changing behaviors.

-

Market Segmentation

Within your customer base, some segments may be more price-sensitive than others. Differentiated pricing ensures you don’t push budget-focused buyers away while capturing higher margins from premium segments.

Identify Your “Pricing Game” and Adapt to Tariff Pressures

Thought leadership by BCG highlights that no single pricing framework (e.g., value-based, elasticity, cost-plus) is universally effective. Instead, companies can be grouped by the “pricing game” they play—driven by their market structure, buyer fragmentation, product differentiation, and competitive intensity. According to researchers, four of these pricing games are especially vulnerable to the first- and second-order effects of tariff changes:

-

Cost Game

-

Nature: Markets driven by cost-plus formulas and a fragmented base of sellers (e.g., some industrial suppliers).

-

Tariff Stress: Tariffs can dramatically increase your cost basis, but the “plus” in cost-plus pricing matters greatly. Watch competitors closely; if your exposure is higher, you may need internal cost-efficiency measures fast.

-

Uniform Game

-

Nature: Transparent, uniform prices for large volumes of relatively undifferentiated products or services (e.g., many consumer goods and retailers).

-

Tariff Stress: Heavy reliance on price elasticity data means big cost shocks may invalidate older models. Understanding new price sensitivities and cross-price effects becomes crucial.

3. Power Game

-

Nature: High-stakes deals in concentrated markets, often with a handful of powerful buyers and sellers (e.g., certain high-tech suppliers).

-

Tariff Stress: Even small cost changes can tip the delicate balance of negotiations. Losing one key account might devastate your bottom line, while a single mispriced deal can lead to a damaging margin spiral.’

4. Custom Game

-

Nature: Highly customized, discounted deals in competitive B2B markets (often thousands of product-price-customer combinations).

-

Tariff Stress: May require frequent “price adjusters” for specific segments or customers. If tariff changes are long-term, discount policies must be recalibrated to preserve both competitiveness and margins.

Understanding which pricing game you play is essential to anticipating how tariffs will affect you—and what targeted strategies will mitigate the risks. A blanket, one-size-fits-all response is typically inadequate.

Phase 2: Craft and Execute Effective Pricing Strategies

Armed with a granular understanding of tariff impacts and clarity on which “pricing game” you’re in, you can develop a nuanced approach to pricing that preserves margins without alienating customers. Importantly, tariffs are not a “free pass” to hike prices indiscriminately — as we’ve seen with inflationary price increases over the last few years. As many market observers have noted, blanket price increases risk volume losses and can erode long-term customer loyalty. Many

1. Optimize Costs and Decide What to Absorb

-

Negotiation with Suppliers

If you can threaten to shift some of your sourcing or consolidate purchases for volume discounts, you may extract better terms that absorb part of the tariff impact. -

Process Improvement

Look for internal inefficiencies—manual tasks, high scrap rates, poor inventory turnover—that inflate costs. Savings from streamlined operations can help offset tariffs without hiking prices too steeply. -

Lean Manufacturing Principles

Apply Lean or Six Sigma to reduce waste throughout the production process. Eliminating unnecessary steps or rework can reclaim margin lost to tariffs. -

Product Redesign

A longer-term play involves engineering changes to reduce reliance on tariff-impacted components or materials. While it may require upfront R&D, it can significantly reduce recurring costs.

Some companies opt for a customer-first narrative, as demonstrated recently by Chipotle:

-

Absorption of Costs: Rather than immediately passing new tariff-driven cost increases on to consumers, Chipotle signaled it would absorb the impact—at least initially—to maintain price stability and build goodwill.

-

Proactive Communication: By addressing pricing concerns before they became a crisis, Chipotle controlled the narrative, reinforcing a customer-centric brand image.

-

Long-Term Considerations: Senior leadership noted this strategy may change if tariffs impose greater financial strain. Still, the initial move positioned the company favorably in the eyes of consumers and the press.

Sometimes absorbing costs briefly can boost trust and brand loyalty, particularly if you clearly communicate the reasons for your decision. Still, it’s crucial to have a plan for phased adjustments, lest you sacrifice margins indefinitely.

2. Differentiate Your Product and Service for Competitive Advantage

-

Focus on total economic value to the customer

Highlighting what makes your product unique—superior performance, reliability, or design—shifts the conversation from price to overall value. -

Innovation

If you can deploy R&D efforts to create new, highly differentiated offerings, you gain pricing power and reduce the impact of commodity-based tariffs. -

Branding

Strong brands can command higher prices and retain loyal customers, even under tariff pressures. Consistent quality, effective storytelling, and memorable experiences build brand equity. -

Customer Experience

Differentiation doesn’t stop at the product. Exceptional service, hassle-free returns, and proactive communication all justify a premium and mitigate the risk of churn when prices rise.

3. Segment Your Market and Deploy Tiered Pricing

-

Identify Customer Segments

Categorize your buyers by price sensitivity, loyalty, and volume. High-volume, less price-sensitive customers might absorb increases more easily. A simple RFM analysis combined with Price Elasticity will do the trick here. -

Develop Tiered Pricing Structures

Offer different tiers of features at various price points. This approach captures value from customers willing to pay more for a premium experience while maintaining an affordable option for more frugal segments. -

Value-Added Bundles

Bundling complementary products or services can enhance perceived value and make a price increase feel like a better overall deal.

4. Use Promotions and Discounts with Surgical Precision

-

Limited-Time Offers

Short-term deals can jump-start sales if customers are hesitant about a post-tariff price level. -

Volume Discounts

Encouraging bulk purchases spreads fixed tariff costs over more units, which helps maintain profitability. -

Loyalty Programs

Reward frequent buyers with perks that offset tariff-driven changes in price, reinforcing loyalty during uncertain times.

Transparent Communication

Consumers and B2B buyers appreciate candor. When it’s clear that tariffs are forcing incremental costs, open dialogue can preserve trust and relationships.

Phase 3: Monitor, Evaluate, and Adapt on the Fly

Pricing strategy isn’t “one and done.” It demands continuous monitoring, fast adaptation, and prompt responses to market feedback—particularly when trade policies evolve rapidly.

Key Performance Indicators (KPIs)

Track metrics like sales volume, profit margins, price realization, customer retention, and competitor price changes. You can even monitor customer sentiment through surveys or social media.

-

Regular Reviews

Schedule periodic check-ins to ensure your pricing strategy remains effective. If you see unexpected declines in volume or shifts in competitor tactics, be ready to pivot fast. -

Competitor Monitoring

Keep your finger on the pulse of the market, especially around your competitive price gaps: how far are you deviating from optimal price gaps vs. key competitors? If rivals are adapting more aggressively (or less), adjust your approach to stay competitive. -

Customer Feedback

Gather ongoing input to understand how customers feel about your prices, product changes, or newly introduced features. This helps refine both your offering and communication strategy. -

Flexibility and Agility

Tariffs can be revised or rescinded on short notice. An ability to quickly re-engineer SKUs, tweak promotions, or recalculate price points will keep you ahead when others are left scrambling.

Don’t Treat Tariffs as a Free Pass: Maintain Pricing Discipline

Even though tariffs provide a rationale for cost increases, the notion of a “free lunch” where you indiscriminately raise prices carries significant risks:

-

Price Increases Aren’t Automatic Windfalls: Volume losses can outweigh margin gains, especially if your customer base is highly sensitive or financially stretched.

-

Who You Sell To Matters: Lower-income or mid-income segments might simply stop buying if costs jump too high, too fast.

-

Consumers Don’t Care About Your Costs: Ultimately, price acceptance hinges on perceived value, not your internal challenges or cost structure.

-

Brand Strength Variances: Smaller, emerging brands may find it harder to sustain repeated price hikes compared to established giants.

-

Tariff Exposure Isn’t Uniform: Some competitors may face lower import duties due to different sourcing strategies, so it’s dangerous to assume everyone will raise prices equally.

-

Value Creation Is Key: The best pricing strategies tie tariff increases to enhancements in product quality or service, preserving loyalty and justifying a higher price point.

Spotlight on Chipotle Again

By choosing to absorb initial cost hikes, Chipotle positioned itself as an advocate for customers—boosting trust and controlling the PR narrative. The brand’s approach reinforces a critical reminder: How you communicate price decisions can matter as much as (or more than) the actual numbers. This type of “customer-first” narrative can generate goodwill, but only if you have the financial resilience to sustain it.

Four Steps You Must Take Right Now

Building on the previous phases, consider these four immediate actions to keep your pricing strategy balanced as tariffs hit:

-

Review Your Value Proposition

Ask yourself how you create value for customers and how tariffs will alter that value. Are you in a market where small cost changes lead to sudden drop-offs in demand? Or a market where slight price increases can be offset by strong differentiation? -

Develop Scenarios for Your Pricing Game

Cost Game, Uniform Game, Power Game, or Custom Game—each faces unique risks and opportunities. Model the impact of tariffs on your competitive advantages, your customer’s willingness to pay, and how rivals may respond. Use scenario heatmaps to visualize both risk exposure and emerging opportunities. -

Make Everyone Part of the Solution

Successful tariff response requires cross-functional engagement—supply chain, procurement, finance, marketing, sales, and senior management. The complexity of tariffs means decisions on pricing need real-time input from multiple fronts. In especially high-stakes “Power Game” markets, the CEO may need to be directly involved. -

Expedite Your Processes

“By the market, not by the textbook.” In an environment where tariffs can change quickly, formal annual or semiannual review cycles won’t cut it. Adopt fast decision loops like monthly Pricing Reviews. Leverage dynamic Pricing and RGM Analytics Dashboards to monitor KPIs, anticipate changes, and adjust prices, discount policies, and promotions based on the changing landscape.

Partner with Revology Analytics for Tariff-Resilient RGM

In such a volatile environment, advanced pricing scenario modeling and insights-driven pricing are a foundational capability that every company must have: it’s no longer a nice-to-have, it’s table stakes in 2025. Revology Analytics specializes in advanced Pricing and Revenue Growth Management (RGM) solutions that guide you through each phase of tariff mitigation:

1. Scenario Analysis & What-If Modeling

-

Simulate multiple cost increases, tariff rates, price increases, discounting, and competitive response scenarios—5%, 10%, 25%—on different SKUs and customer segments.

-

See how changes in supplier prices, exchange rates, or competitor moves might affect your revenue, gross profi,t and volumes.

2. Surgical Pricing & Segmentation

-

Instead of broad, one-size-fits-all price changes, use Revology’s analytics to fine-tune adjustments and be surgical with your pricing approaches.

-

Integrate cost absorption with tiered pricing and value-added bundles, minimizing volume loss while capturing higher margins where possible.

3. Transparent Communication Framework

-

We can help your teams implement best-practice price increase communication for explaining necessary price changes to your customers, maintaining trust and clarity even under pressure.

Who Thrives with Revology

-

Mid-market firms (up to ~ $1B in revenues) looking for advanced Pricing and RGM analytics without the overhead of large-scale enterprise tools.

-

Manufacturers, Distributors, and Retailers that need fast ROI and want to modernize their pricing approach.

-

Teams Committed to Insights-Driven Pricing: RGM success relies on continuous improvement, cross-functional collaboration, and the agility to course-correct.

Embrace a Long-Term, Value-Centric Approach to Tariffs

Tariffs are here, and they’re reshaping costs in ways that can drastically affect your bottom line. But with a strategic, analytics-informed approach, companies can be smart about their price response.

By conducting a thorough cost analysis, identifying your pricing game, deploying multi-phase price adjustments, offering enhanced value to justify those adjustments, and leveraging best-in-class Pricing Analytics and Strategy capabilities from partners like Revology Analytics, you can transform the tariff challenge into a sustainable competitive advantage.

Don’t wait for tariffs to subside or for the market to “normalize.” Act now:

-

Map your costs and identify where tariffs hurt most.

-

Use scenario analyses to craft precise, tailored pricing strategies that align with the game you’re playing.

-

Ensure your customers see the added value that justifies price changes.

-

Monitor, measure, and adapt continuously—bringing the entire organization into the pricing process.

While tariffs are often temporary, and long-term, they can have material consequences. The key is preparedness, agility, and a multi-faceted approach that fuses rigorous Pricing Analytics with on-the-ground market insight. With these ingredients, you can not only mitigate tariff-induced volatility but potentially leverage it to strengthen your competitive position in the long run.