Phase 2: Targeted Quick Wins & Actionable Recommendations

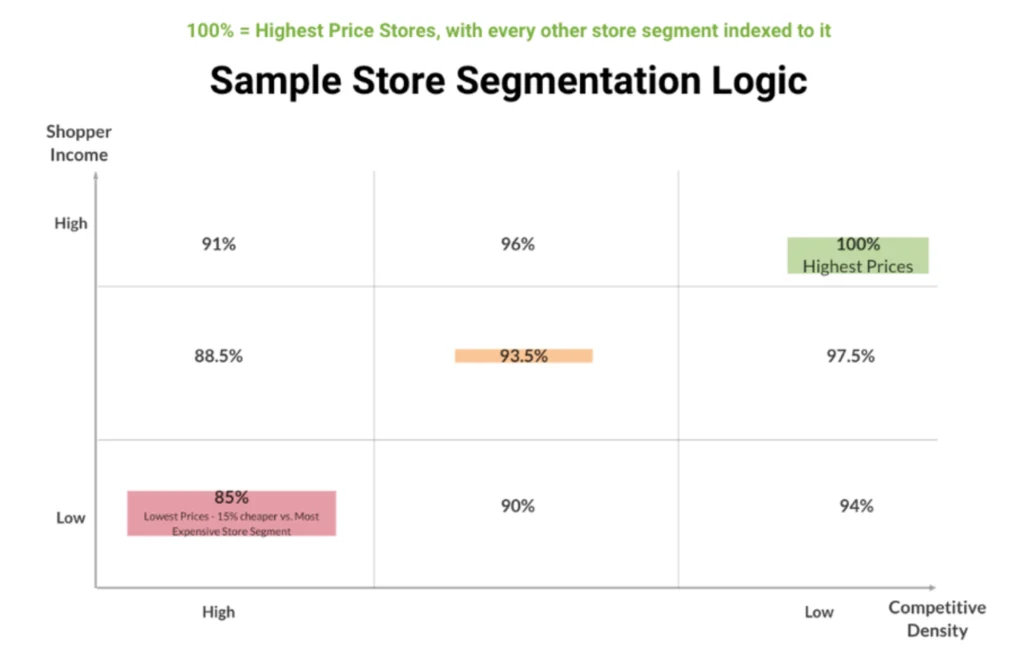

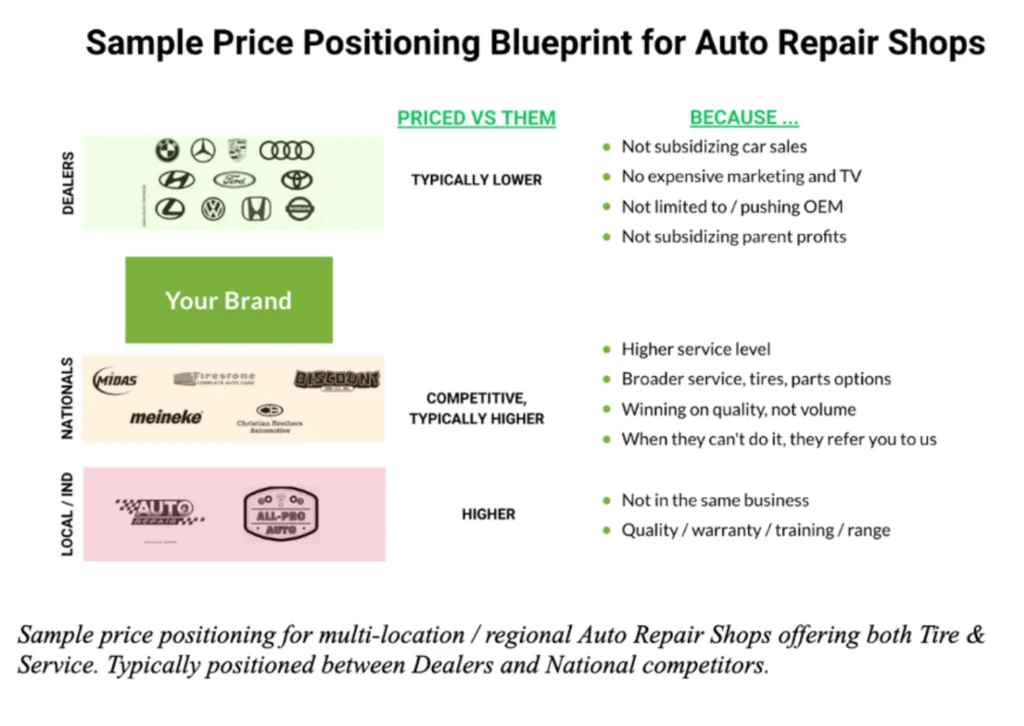

● Parts Matrix Optimization & Value-Based Segmentation: We developed a simplified and more logical parts markup matrix, significantly reducing complexity, improving transparency, and streamlining pricing decisions. We introduced a shopper and competition segmentation approach, leveraging data on shopper demographics and competitive densities to further refine pricing within the matrix and maximize profitability.

● Tires Pricing Quick Wins & Competitive Benchmarking: Identified and recommended immediate price adjustments for competitively underpriced tires, targeting an optical competitive price index with a minimum gross profit percentage threshold. This involved extensive competitive benchmarking to ensure pricing remained competitive while maximizing profitability.

● Shop Supplies Fees Analysis & Standardization: Conducted a thorough analysis of the impact of shop supplies fees on customer behavior and revenue. Based on this analysis, we recommended a more standardized fee structure across banners to maximize revenue while maintaining customer acceptance.

● Data & Systems Enhancements & Automation: Recommended key enhancements to the existing POS and data infrastructure to enable more sophisticated pricing strategies, automated processes, and improved data analysis. This included recommendations for data integration, standardization, discount and promotional code streamlining, and key reporting capabilities around pricing KPIs.

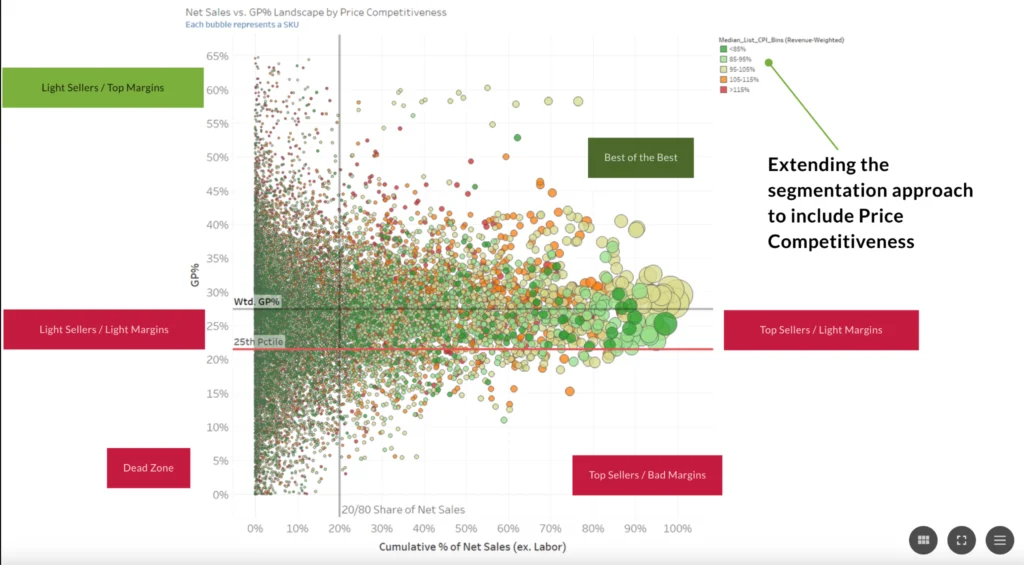

● Advanced Analytics & Custom Reporting Dashboards: Developed interactive analytics dashboards in Tableau to provide real-time insights into key pricing and operational metrics. These dashboards provided a centralized platform for monitoring price realization, price-volume-mix impacts, discount effectiveness, customer behavior, and profitability.