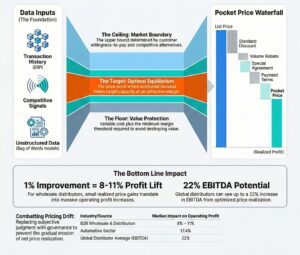

The most dangerous threat to profitability for distribution, manufacturing, and retail leaders isn’t a sudden market crash; it’s the slow, silent erosion of margin within their pricing structure. While most executives focus on volume and cost-cutting, they often overlook the immense power of pricing. This isn’t a minor oversight. A recent Revology Analytics study of nearly 2,000 companies confirms that a 1% improvement in price realization yields a median operating profit increase of 6.4%. This leverage, however, varies dramatically by industry, soaring to 17.4% for Automotive companies and 9.2% for Consumer Staples, highlighting that for many, pricing remains the single most potent lever for financial performance.

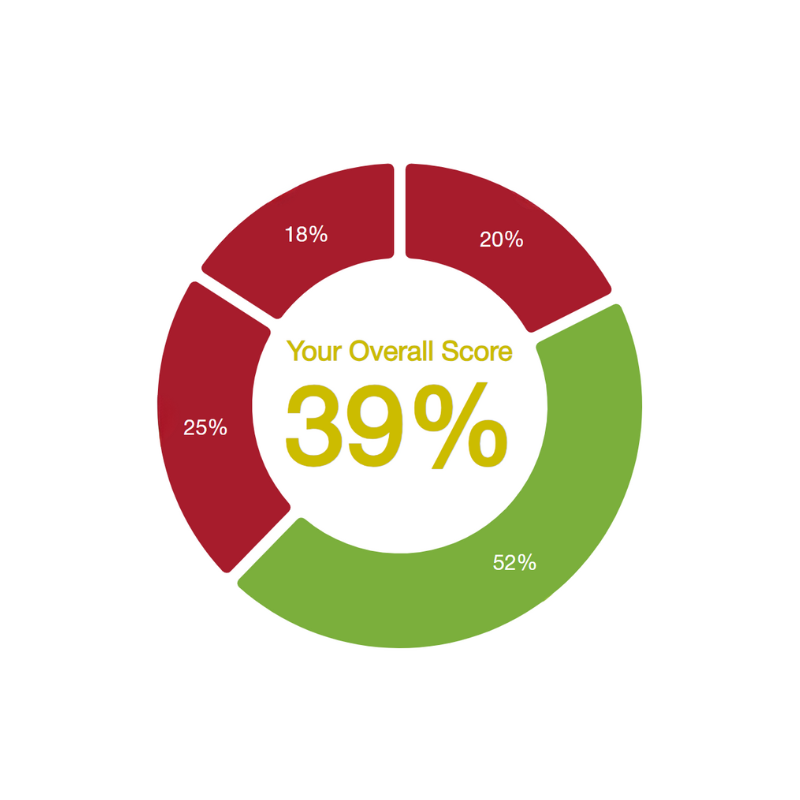

Yet, despite this extraordinary leverage, most companies fail to capture the prices they plan. A landmark Simon-Kucher Global Pricing Study found that companies, on average, only achieve 48% of their planned price increases after accounting for all discounts, rebates, and concessions.

This staggering statistic reveals a profound truth: for every dollar of intended price uplift, more than fifty cents vanishes into a complex web of discounts and allowances. This is the “Leaky Pricing Waterfall” in action, a concept detailed in Pricing and Profitability Management. Your list price sits at the top, but as the water cascades through on-invoice discounts, off-invoice rebates, and freight costs, its volume shrinks. The final “pocket price”—what you actually collect—is often a fraction of what it could be. Compounding this issue, the 2025 Revenue Growth Analytics Maturity Report reveals that over half of companies (50.7%) don’t even have a price waterfall in place to track these leaks, operating with a massive blind spot where profit disappears.

Why Your Pricing Waterfall Is Eroding Your Margin

This profit erosion isn’t random; it occurs at predictable points in your commercial process, often masked by top-line revenue growth. Understanding where these leaks spring from is the first step toward plugging them permanently, transforming your pricing structure from a source of loss into a powerful engine for growth.

1. The List Price: An Unstable Foundation

The first and most significant leak often originates at the very top: the List Price itself. Recent findings from the 2025 Revenue Growth Analytics Maturity Report shed new light on this problem. The report shows that while most companies are trying to move in the right direction—with 56.4% setting specific pricing goals for different customer or product segments—their efforts are often superficial. The same report reveals that these efforts rarely translate into true value-based pricing. A mere 24.3% of companies determine their prices by assigning a sophisticated, value-based assessment to each market segment. In stark contrast, a combined 75.7% continue to rely on simpler, less-differentiated methods, such as a “cost-plus and/or competition-based approach” or purely “subjective factors.” When your price is anchored to your costs instead of your customer’s benefit, you place an artificially low ceiling on your potential profit before the first negotiation even begins.

2. On-Invoice Discounts: The Unchecked Habit

From there, the leaks multiply. On-Invoice Discounts, such as volume breaks, are frequently granted based on historical norms and gut-feel rather than data-driven analysis. The conventional wisdom that high volume deserves a steep discount is often a dangerous oversimplification. Without an optimized discount curve that models true profitability, you are likely subsidizing your largest customers’ profits at your own expense, rewarding volume you may have won anyway at a much higher margin. This is not strategic discounting; it is a habit that corrodes value.

3. Off-Invoice Rebates: The Black Hole of Spend

Then comes the deluge of Off-Invoice Rebates and promotional allowances. This is often the most significant and least understood leakage area. Billions are spent on trade promotions and co-op marketing funds with little visibility into their true ROI. You are likely funding promotions that merely shift volume from one week to the next or subsidize sales that would have occurred anyway. This “black hole” of spending can drain marketing budgets with little to show for it, all while creating customer expectations for continuous discounts.

4. Sales Overrides and Culture: Death by a Thousand Cuts

Finally, these leaks culminate in the final pocket price, eroded further by a culture of ad-hoc sales overrides. A well-intentioned sales rep might offer a final concession to close a deal at the end of a quarter. While individually justifiable, these small discounts accumulate into millions of dollars in lost profit annually. More dangerously, this fosters a culture where price is seen as the primary lever to win business, commoditizing your brand and training your sales team to sell on price instead of value.

A Blueprint for a Value-Based Pricing Engine

Reversing this trend requires moving beyond the limitations of spreadsheets and instinct. It demands a systematic approach to re-architecting your entire pricing methodology. The journey from data chaos to pricing clarity involves building an in-house capability grounded in causal data and designed for commercial action.

Step 1: Establishing a Causal Data Foundation

The bedrock of any robust pricing strategy is an integrated and trustworthy data foundation. For most companies, transactional, customer, and product data sits in disconnected silos—the ERP, the CRM, and various sales platforms. The first practical step is to combine these sources into a cohesive whole and analyze them at the transaction level.

However, the true transformation happens when we move beyond seeing what happened to understand why it happened. This is the application of advanced causal machine learning. Standard analytics can show you dangerous correlations. For example, you might see that sales are highest when your biggest discount is active. The flawed conclusion is that the discount drove the sales. A causal model, however, can control for other factors (like seasonality or competitor actions) to determine if the discount caused the increase or simply coincided with it. This distinction is everything. By establishing a causal foundation, we eliminate guesswork and build strategies on a defensible, fact-based understanding of the market.

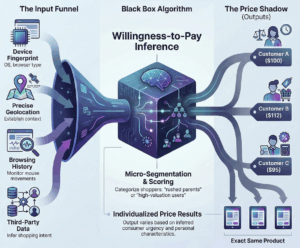

Step 2: Architecting the Price Customization Framework

With a clear, causal understanding of your data, you can design an intelligent pricing engine. This involves deploying a multi-tiered segmentation strategy—what Dolan and Simon call price customization—to align price with value across every transaction. The goal is to capture more of the total “profit potential triangle.” A single price for all customers inevitably leaves profit behind in two ways:

-

Passed-Up Profit: Customers who would have paid more than your cost but less than your single price don’t buy at all.

-

Money Left on the Table: Customers who would have paid much more than your single price get it for a bargain.

An intelligent customization framework minimizes these losses by building “fences” that segment customers. This isn’t about creating a more complicated price list, but a dynamic framework that adapts to context using four primary sorting mechanisms:

-

Product-Line Sort: Offering “Good-Better-Best” versions (like Kodak’s Funtime, Gold, and Royal Gold films) allows customers to self-select into tiers that match their needs and willingness to pay.

-

Controlled Availability: Selectively offering prices through specific channels, coupons, or regional campaigns ensures that discounts are targeted to the most price-sensitive customers.

-

Sort on Buyer Characteristics: Observing attributes like age (senior discounts), institution type (academic vs. corporate pricing), or user status (new vs. upgrade pricing) allows for direct price differentiation.

-

Sort on Transaction Characteristics: Using quantity (volume discounts), timing (early-bird specials), or bundling (software suites) as the basis for price variation.

By implementing these fences, you move from a one-size-fits-all price to a dynamic structure that captures value far more effectively.

Step 3: Deploying an Accessible, Actionable Analytics Platform

Advanced analytics are useless if trapped in a “black box” or accessible only to a few data scientists. The final step is to place this power directly into the hands of your commercial leaders. The deliverable is not a hundred-page report; it is a dynamic, user-friendly analytics platform—a living tool integrated into your team’s daily workflow.

Imagine a dashboard where your pricing manager can simulate the margin impact of a new discount structure before it goes live, or where a sales leader in the field can see a real-time “deal score,” guiding them on how much flexibility they have without destroying profit. A critical part of this deployment is fostering user adoption. By co-building these solutions with your team, they feel a sense of ownership from day one. This collaborative process ensures the tool is not seen as an external mandate, but as a powerful new weapon in their arsenal.

Turning Recaptured Value into Measurable Growth

When this blueprint is executed, companies cease to be victims of their pricing complexity and instead become masters of it. The payoff is a tangible transformation from a reactive, firefighting culture to a proactive, strategic one.

Consider the case of Deutsche Bahn, the German national railroad. For years, riders paid a simple per-kilometer price. This structure made driving seem more economical for most travelers, who only considered the marginal cost of fuel. By introducing the “BahnCard”—a two-part tariff where customers pay an upfront fee for a 50% discount on all subsequent trips—the railroad fundamentally changed the value equation. The incremental cost of a train trip now fell below the cost of driving, dramatically increasing both volume and profit. This wasn’t just a price cut; it was a structural innovation that unlocked immense value.

Or take the case of a leading CPG manufacturer whose trade promotions were a black hole of spending. By implementing a Promotion Effectiveness platform, they gained the ability to run data-driven experiments, cutting ineffective promotions and doubling down on those that drove true incremental volume. The result was an 8% increase in gross profit and a 15% improvement in trade investment ROI.

Beyond the numbers, these companies discover powerful secondary benefits. A sophisticated pricing capability becomes a competitive moat, making the business more agile and resilient. Furthermore, when Finance, Sales, and Marketing all work from the same causal data, internal friction disappears, and decision velocity increases dramatically.

Building a Lasting Capability, Not a Temporary Solution

For decades, business leaders have been presented with two flawed models for solving complex challenges: either license a rigid “black-box” piece of software that forces you to adapt your business to its logic, or hire a large consultancy that provides excellent strategic advice but leaves your team no more capable of executing it after they’re gone.

We believe in a third way: strategic empowerment. The goal should not be to simply install a tool or adopt a strategy, but to build a permanent, in-house capability. This is a philosophical choice about the kind of organization you want to lead—one that is self-reliant, agile, and continuously learning from its data. It’s about developing your greatest asset: your people, by equipping them with the tools and skills to make smarter, more profitable daily decisions.

Choosing a partner for this journey is less about a purchase and more about aligning vision. The right partner acts as a temporary catalyst, providing the framework, advanced tools, and expert guidance needed to help your team build the muscle themselves. They work with the explicit goal of making themselves obsolete, ensuring the value created remains with you long after the engagement ends.

If you are a leader who believes in building sustainable, internal capabilities and wishes to explore how these principles can be applied to your own pricing challenges, we invite you to talk with us.

Contact Revology Analytics for a complimentary discovery session. Let’s explore how a data-driven, in-house pricing capability can become your next great competitive advantage.