Building Dynamic Pricing for Fortune 500 Specialty Retailer - Case Study

Implementing dynamic pricing in brick & mortar stores to enhance profitability and market share for a leading specialty retailer.

SITUATION

A Fortune 500 specialty retailer aimed to expand market share and profitability by introducing dynamic pricing in its nationwide brick-and-mortar (B&M) stores.

While adaptive pricing was successfully implemented online, the B&M channel, which accounted for 90% of sales, faced challenges and resistance.

The specialty retailer sought to leverage dynamic pricing to bolster its market share and profitability across its extensive network of brick-and-mortar stores.

Despite successfully implementing adaptive pricing in their e-commerce channel, transitioning this capability to physical stores proved difficult. This was particularly concerning as 90% of their sales were generated through B&M channels.

-

Resistance to adaptive pricing in physical stores was a significant hurdle. Additionally, only 10% of stores were equipped with costly electronic shelf labels, which could facilitate dynamic pricing.

The company faced logistical challenges in updating prices manually across numerous locations, complicating the adoption of dynamic pricing in its primary sales channel.

ACTION

We engaged with category executives, developed competitive price elasticity models, and created a Dynamic Price Optimization Matrix.

We launched a pilot program to assess the impact before a full-scale rollout.

To address these obstacles, we first engaged with category executives to understand their goals. We also invested in robust competitor price-scraping capabilities.

This allowed us to develop Competitive Price Index Elasticity models, providing insights into their products' sensitivity to competitor price changes.

Next, we segmented products into Key Anchor Items, Value Perception Items, Assortment-Perception Items, and Complementary Products. This segmentation enabled a more nuanced approach to dynamic pricing, tailored to each product's specific role in the assortment.

-

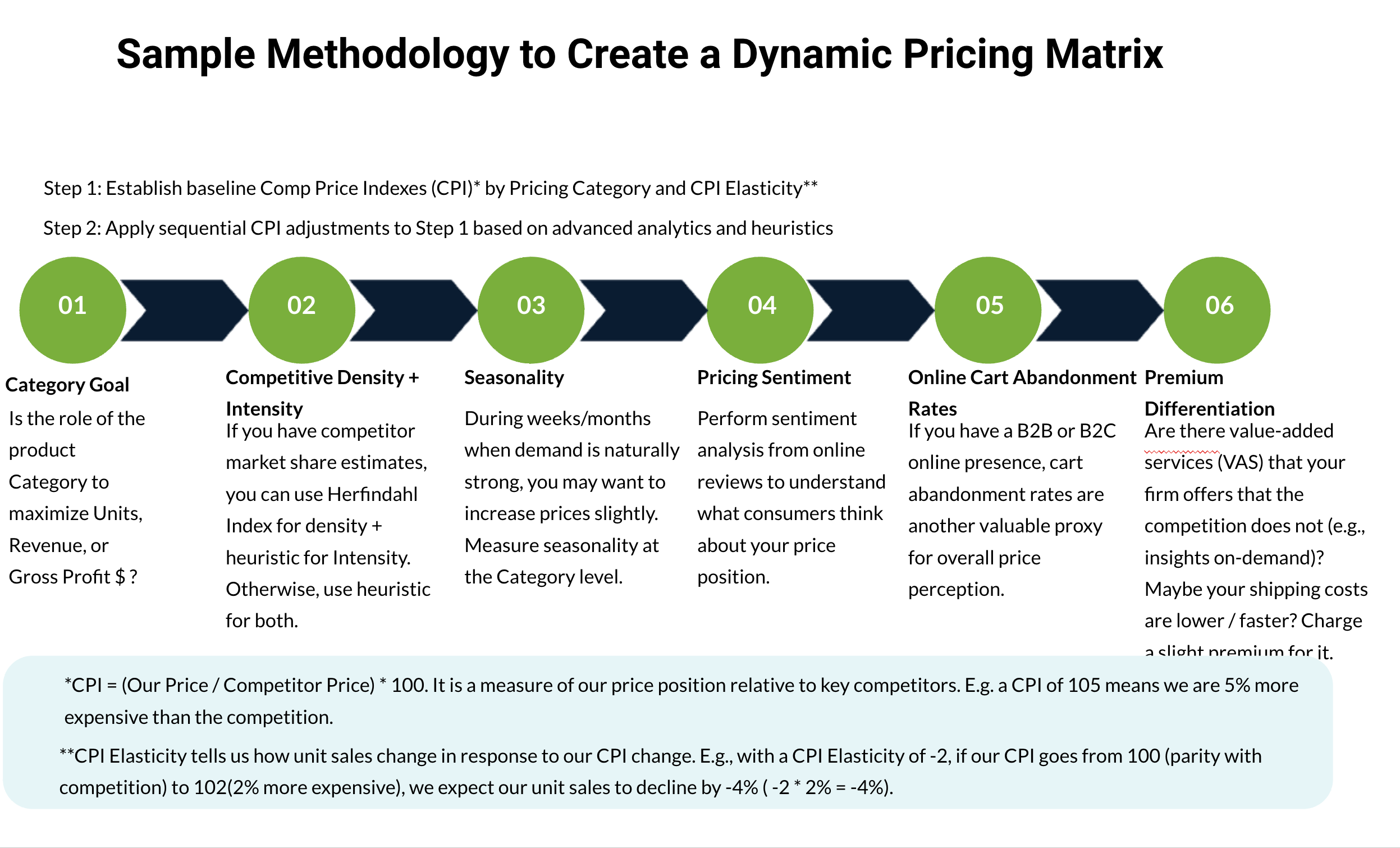

We then created a Dynamic Price Optimization Matrix, which considered category goals, competitive price sensitivities, seasonality, pricing sentiment analyses, and other relevant factors. This matrix served as a blueprint for implementing dynamic pricing across the B&M stores.

Collaborating with stakeholders, we automated the price execution process, incorporating manual review steps for Key Anchor Items. We developed a Minimum Viable Analytics Solution (MVAS) and deployed a pilot to evaluate the impact of the new pricing strategy.

We conducted iterative roadshows with senior executives, category leaders, and finance and merchandising teams to ensure alignment and buy-in.

This process allowed us to demonstrate progress, gather feedback, and refine the solution. Following the successful pilot, we rolled out the complete solution, providing clear Dynamic Pricing Guidelines for the Pricing, Finance, and Commercial teams.

Example output of the dynamic pricing matrix

Sample Product Segments using in dynamic pricing strategies

OBSTACLES

The company faced skepticism towards dynamic pricing in physical stores and needed an automated solution for a broad range of products.

The labor-intensive and costly process of changing price tags added to the complexity.

The initial reception of dynamic pricing in the e-commerce channel was positive, but the B&M channel met with considerable skepticism.

Stakeholders were hesitant to embrace adaptive pricing for physical stores, fearing potential customer backlash and the logistical challenges involved.

-

The company aimed to implement an automated pricing solution for the long tail of its product assortment while adopting a hybrid approach for Key Value Items that required merchant approvals.

However, the physical process of changing price tags was labor-intensive and expensive, particularly for stores without electronic shelf labels.

Moreover, the company sought to update its dynamic pricing strategy for the online channel based on new insights from price elasticity and assortment models.

Integrating these new models into their existing systems added another layer of complexity to the project.

The steps to create a dynamic pricing framework

RESULTS

The dynamic pricing solution increased Gross Margin by 30 basis points in tested categories, was cost-effective, and facilitated full adoption by key stakeholders.

The dynamic pricing solution delivered significant results. A 30 basis point increase in Gross Margin was observed in 25 product categories through an A/B test. This improvement demonstrated the efficacy of the dynamic pricing strategy in enhancing profitability.

We successfully delivered the automated, dynamic pricing capability at just 25% of the cost and 50% of the time compared to solutions from large blue-chip consulting firms. This cost efficiency underscored the value of our tailored approach to dynamic pricing.

-

Moreover, the active involvement of category executives and senior merchants throughout the dynamic pricing journey ensured the solution's complete adoption.

Their engagement was critical in aligning the pricing strategy with the company's broader business objectives.

Overall, the approach allowed for an increase in profits without compromising market share.

Additionally, significant labor costs were saved by eliminating the need for manual price setting, further enhancing the overall efficiency and effectiveness of the dynamic pricing strategy.

Subscribe to

Revology Analytics Insider

Revenue Growth Analytics thought leadership by Revology?

Use the form below to subscribe to our newsletter.