Unlocking Sales Performance with Commercial

SITUATION A leading global agricultural chemical manufacturer, specializing in crop protection, sought to enhance its sales analytics capabilities to drive

Have a Revenue Growth Analytics pain point, a question, or a content suggestion?

Discover how Revology Analytics propels mid-market businesses to sustainable, profitable growth by building advanced, in-house Revenue Growth Analytics & Management (RGM) capabilities—fast.

Our senior expert-led, hands-on approach ensures you own the tools, insights, strategy and processes needed to thrive long-term.

Gain exclusive access to the latest insights from over 150 commercial leaders on the state of Revenue Growth Analytics in 2025, based on our expanded Revenue Growth Analytics Maturity Scorecard™.

Access our comprehensive advisory services, where Pricing and Revenue Growth Management transformations are at the core.

We also specialize in Sales & Marketing AI Enablement and Commercial Analytics transformations. In 90–120 days, our senior practitioners embed advanced solutions, equipping organizations with enduring, in-house growth engines that drive measurable results.

Discover how Revology Analytics propels mid-market businesses to sustainable, profitable growth by building advanced, in-house Revenue Growth Analytics & Management (RGM) capabilities—fast.

Our senior expert-led, hands-on approach ensures you own the tools, insights, strategy and processes needed to thrive long-term.

Explore Revology Analytics’ curated thought leadership on various Revenue Growth Analytics and Management topics.

Our case studies, white papers, webinars, and toolkits illuminate best practices and emerging trends. Gain actionable insights to refine your holistic Revenue Growth Management strategies and capabilities, fueling sustainable, profit-focused decisions across your organization.

Discover how Revology Analytics propels mid-market businesses to sustainable, profitable growth by building advanced, in-house Revenue Growth Analytics & Management (RGM) capabilities—fast.

Our senior expert-led, hands-on approach ensures you own the tools, insights, strategy and processes needed to thrive long-term.

Gain exclusive access to the latest insights from over 150 commercial leaders on the state of Revenue Growth Analytics in 2025, based on our expanded Revenue Growth Analytics Maturity Scorecard™.

Access our comprehensive advisory services, where Pricing and Revenue Growth Management transformations are at the core.

We also specialize in Sales & Marketing AI Enablement and Commercial Analytics transformations. In 90–120 days, our senior practitioners embed advanced solutions, equipping organizations with enduring, in-house growth engines that drive measurable results.

Discover how Revology Analytics propels mid-market businesses to sustainable, profitable growth by building advanced, in-house Revenue Growth Analytics & Management (RGM) capabilities—fast.

Our senior expert-led, hands-on approach ensures you own the tools, insights, strategy and processes needed to thrive long-term.

Explore Revology Analytics’ curated thought leadership on various Revenue Growth Analytics and Management topics.

Our case studies, white papers, webinars, and toolkits illuminate best practices and emerging trends. Gain actionable insights to refine your holistic Revenue Growth Management strategies and capabilities, fueling sustainable, profit-focused decisions across your organization.

We help pharmaceutical manufacturers unlock data-driven pricing and revenue growth by combining automated product equivalence mapping, advanced elasticity modeling, and scalable analytics capabilities that thrive in complex, partially regulated markets.

Revology Analytics enables pharmaceutical teams to build modern pricing and revenue growth management capabilities across Rx and OTC portfolios. By integrating internal sales and cost data with syndicated market sources such as IQVIA, we identify pricing quick wins, optimize competitive positioning, and create sustainable, analytics-powered pricing operating systems.

Pharmaceutical companies contend with intense branded generic competition, overlapping regulations, and high-stakes pricing decisions. Relying on static spreadsheets or simple benchmarks is no longer enough. Our pharma work focuses on three pillars:

Beyond analytics, we emphasize capability building—training your teams to maintain the PEM, refresh models, interpret outputs, and embed pricing analytics into standard business rhythms so value continues to compound after the project ends.

Rules-based equivalence logic achieving >95% SKU coverage and harmonizing internal product views with IQVIA market data.

Causal ML-based price elasticity models and a recommendation engine that surfaced SKU-level price opportunities with quantified volume, revenue, and margin tradeoffs.

Training, documentation, and governance frameworks that embedded PEM maintenance, model refresh cycles, and pricing decision standards into day-to-day operations.

Excel/BI tools that allowed local teams to simulate price moves, evaluate CPI positions, and communicate impact in a common language to finance and leadership.

SITUATION A leading global agricultural chemical manufacturer, specializing in crop protection, sought to enhance its sales analytics capabilities to drive

SITUATION A leading national auto service and tire retailer with nearly $1 billion in annual revenue and 350+ stores across

SITUATION Client BackgroundThe Client, a Private Equity owned ultra-premium fresh pet food provider, had been growing primarily through DTC.Beside premium

SITUATION Client BackgroundThe Client, a privately owned premium pet food & pet products multinational company, sells under a portfolio of

SITUATION Private Equity InvolvementOne of the world’s leading private equity firms acquired a major stake in Client co.The firm was

Have a Revenue Growth Analytics pain point, a question, or a content suggestion?

The Hurt Hub@Davidson

210 Delburg St, Davidson, NC 28036, United States

+1 803-701-9243

We would love to hear from you.

Centered on proven best practices, Revology Analytics® provides Revenue Growth Analytics advisory services and thought leadership, driving profitable revenue growth for middle-market companies.

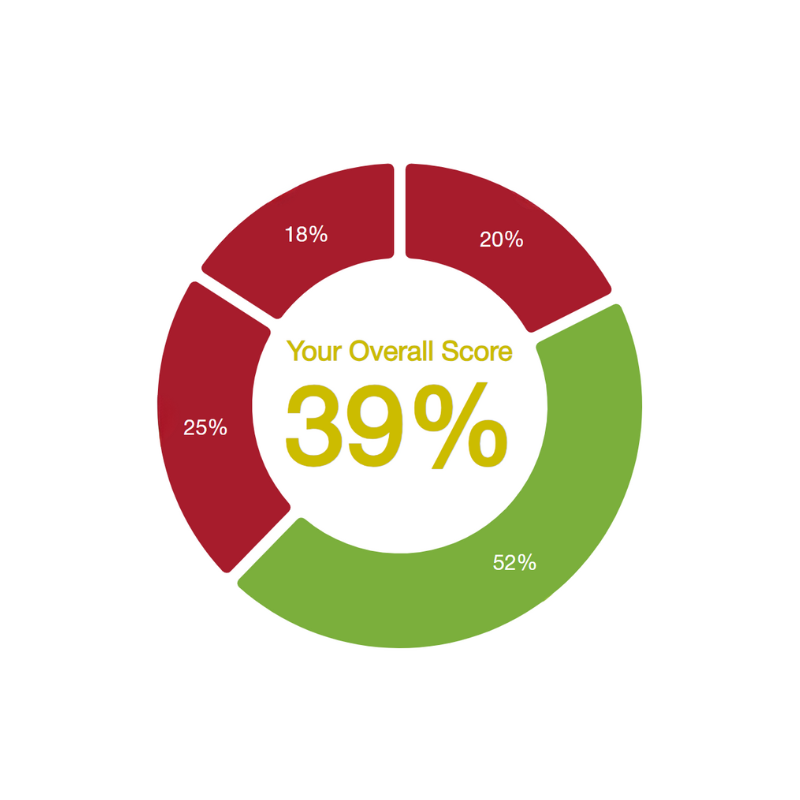

Over 225 companies took our scorecard to improve their Revenue Growth Analytics & Management capabilities.

Copyright@2026 Revology Analytics LLC