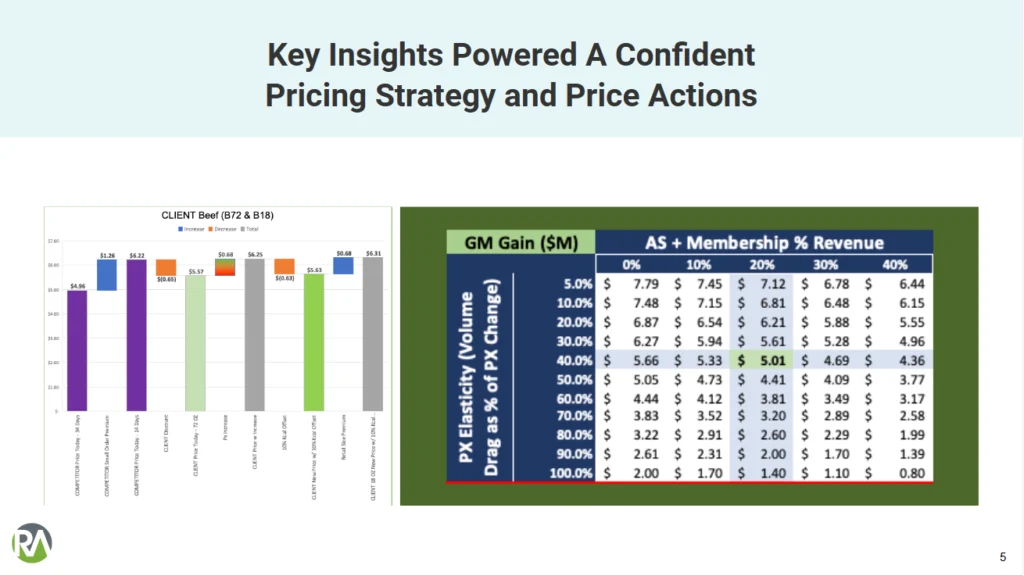

Unlocking Sales Performance with Commercial Analytics Transformation in the Agricultural Chemical Industry – Case Study

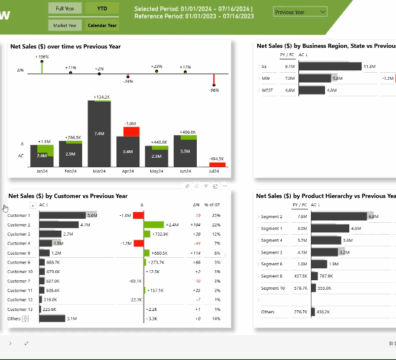

SITUATION A leading global agricultural chemical manufacturer, specializing in crop protection, sought to enhance its sales analytics capabilities to drive