Elevate Your Pricing Strategy:

Understand and Quantify Customer Price Sensitivities

Download the

FREE White Paper

“Revology Analytics delivers a brilliant fusion of business expertise, data analytics, and the technical complexities of Revenue Growth Management. The topics they cover directly mirror the strategic challenges and data-driven decisions we face daily—it’s reassuring to know we’re not alone.

They excel at making complex insights easy to understand and apply, regardless of our industry’s specifics. Their work inspires us to become better professionals, ignites our curiosity, and encourages us to apply new concepts using our data.” - ”

Mastering Price Elasticity Modeling: A Comprehensive Guide for Pricing, Analytics and Finance Professionals

Companies that understand granular customer price sensitivities drive greater operating profits by employing smarter pricing strategies than their competitors. Our comprehensive guide reveals how to turn this challenge into an opportunity.

Why Knowing Your Price Elasticities Matters

Understanding price elasticity—the relationship between price changes and demand—is essential for any business seeking to win in a dynamic marketplace. Effective price elasticity modeling provides the insights you need to anticipate customer reactions, adjust pricing, and maintain profitability and competitiveness even in volatile conditions.

What You Will Learn

Our 50-page guide dives into both foundational and advanced techniques, including:

Linear Regression and Advanced Machine Learning Approaches: Learn about regression-based modeling approaches, as well as sophisticated methods like Random Forest, Gradient Boosting, and Double Machine Learning.

Data Aggregation Strategies: Understand how to choose between store-level and chain-level data to maximize model accuracy and minimize costs.

Cross-Price Elasticity and Competitive Price Index Elasticity: Gain insights into the interplay between your products and your competitors' products.

Break-Even Price Elasticity Analysis: Apply break-even analysis to prevent profit loss and make smarter pricing decisions.

Designed for Pricing and Finance Leaders, Data Scientists, and Decision-Makers

This guide offers practical frameworks to help you:

Optimize Pricing Decisions: Develop more precise, machine learning-driven models tailored to market conditions and demand fluctuations.

Enhance Profitability: Use elasticity insights to fine-tune pricing strategies for improved revenue and profit growth.

Model Consumer Behavior: Predict customer purchasing patterns to stay ahead of market shifts.

Leverage Advanced Analytical Tools: Apply cutting-edge techniques, from regression to machine learning, for better decision-making.

Strategically Position Your Market Offerings: Stay competitive by understanding price sensitivities across product lines and market segments.

Key Insights You'll Gain:

Access to advanced elasticity modeling algorithms and educational materials, from linear regression to machine learning models and Double Machine Learning (DML).

Discover the significance of break-even volume and elasticity hurdles and how they impact pricing decisions.

Learn the importance of selecting a suitable model and mitigating data quality issues.

Explore practical tips and best practices for implementing elasticity modeling effectively.

Take Action: Transform Your Pricing Strategy Today

In a competitive market, mastering price elasticity modeling gives your team the tools to make informed, impactful decisions. Download the complete guide to transform your pricing strategy into a competitive advantage.

Download Now to gain additional access to exclusive tools, R/Python scripts, and slides designed to help your team master price elasticity modeling and drive revenue growth.

Stay informed on the latest trends and insights by connecting with us through our social media profiles.

Revenue Growth Analytics Practice Areas

Boost Revenue and Optimize Profitability: Advanced Pricing Analytics and Strategy Solutions for Your Business.

Unlock Sales and Marketing Potential with AI/ML-Powered Analytics Solutions.

Commercial analytics solution for the modern CFO, Chief Transformation, and Strategy officers

What is Revenue Growth Analytics?

Revenue growth analytics employs advanced analytics, machine learning, and artificial intelligence (AI) to identify and capitalize on opportunities to boost your company's revenue and profits.

Our revenue growth analytics experts analyze and optimize pricing strategies, sales and marketing productivity, and promotional investments to drive growth.

By analyzing these areas, we can identify actionable insights to refine your strategic revenue growth approach and significantly boost your sales and profitability.

Take the Revenue Growth Analytics Maturity Scorecard

This quiz has been designed to highlight areas of strength & weakness when it comes to your company's revenue analytics capabilities.

Want to know how to augment your Revenue Growth Analytics capabilities to be industry best-in-class?

Get Free Tools and Resources on How to Grow Your Business

Sign up to receive free access to our growing collection of Revenue Analytics resources, predictive models, and guides.

Learn more about our Pricing & Revenue Management advisory services

-

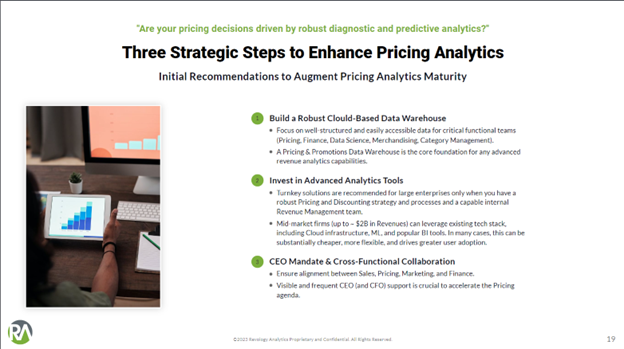

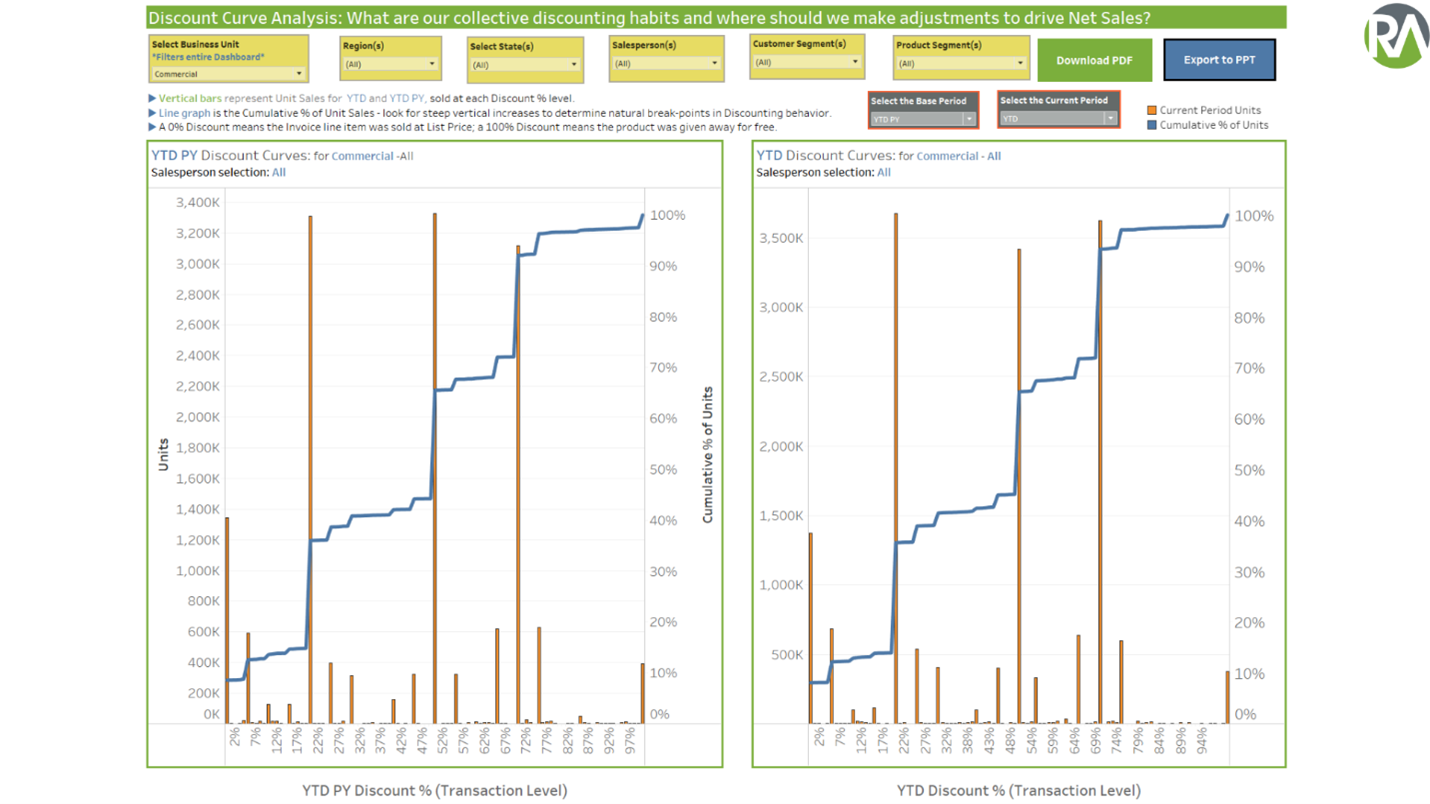

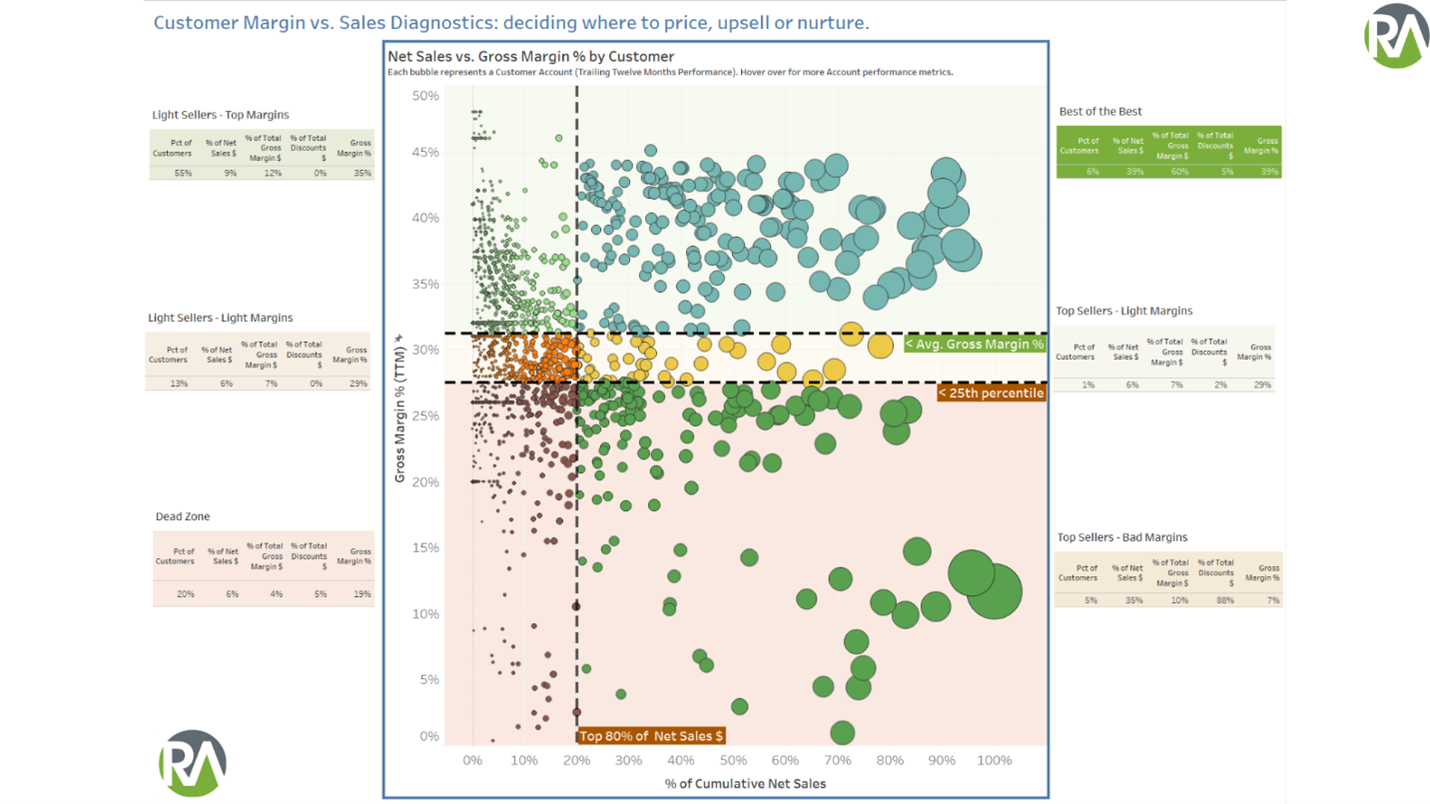

Tableau and Power BI Dashboard Development and Data Storytelling for Pricing, Sales, and Marketing Excellence: helping you and your functional leaders pay attention to the few key synthesized insights that move your business and customers forward. Tailored data visualization solutions cover various areas within the Pricing, Promotions, Sales, and Marketing domains.

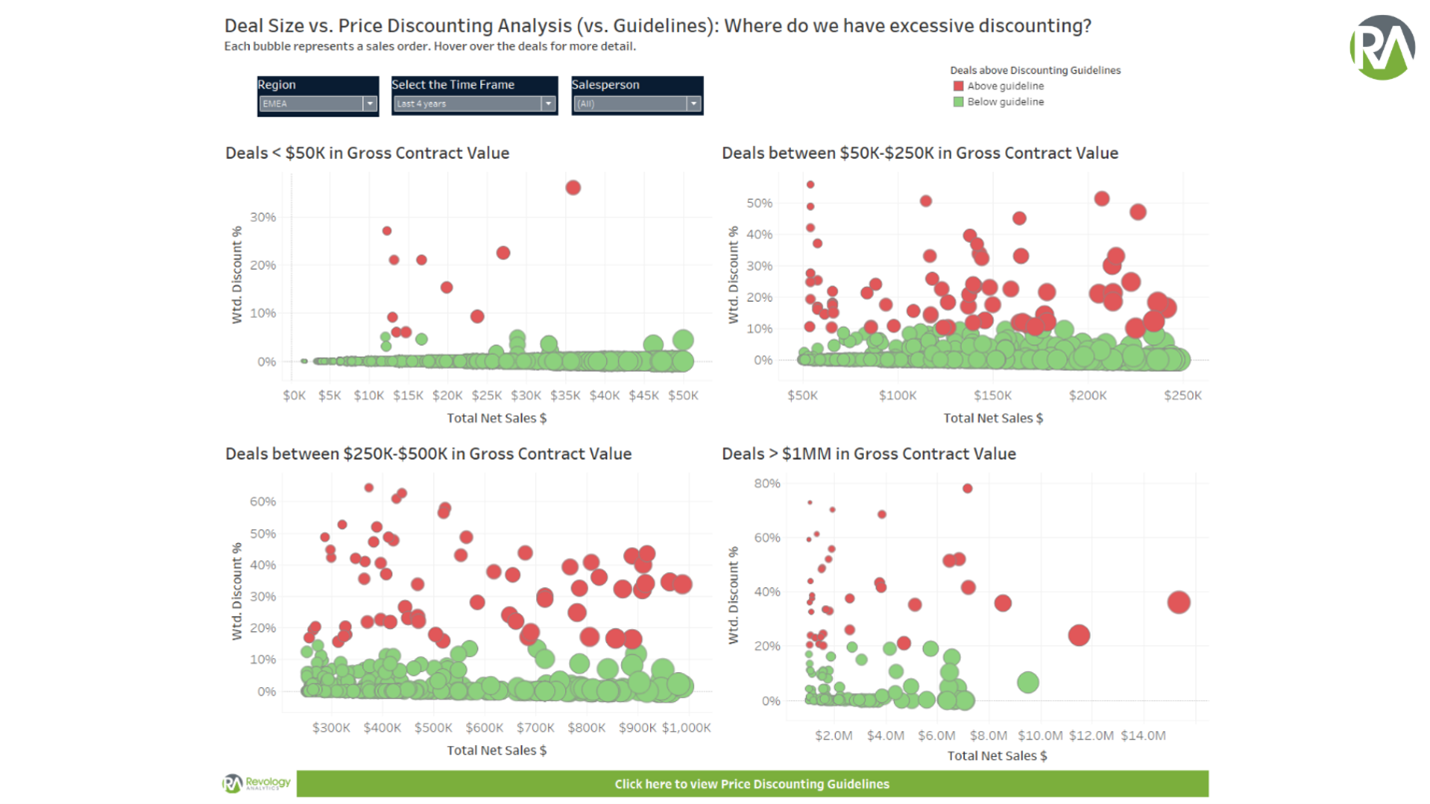

Price Waterfall and Profit Leakage Analysis: pinpointing significant opportunities in your transactional pricing, helping your Pricing and Sales teams recapture lost profits, and putting more money in your pockets.

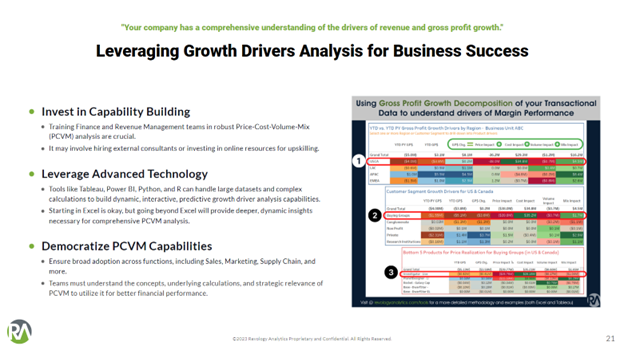

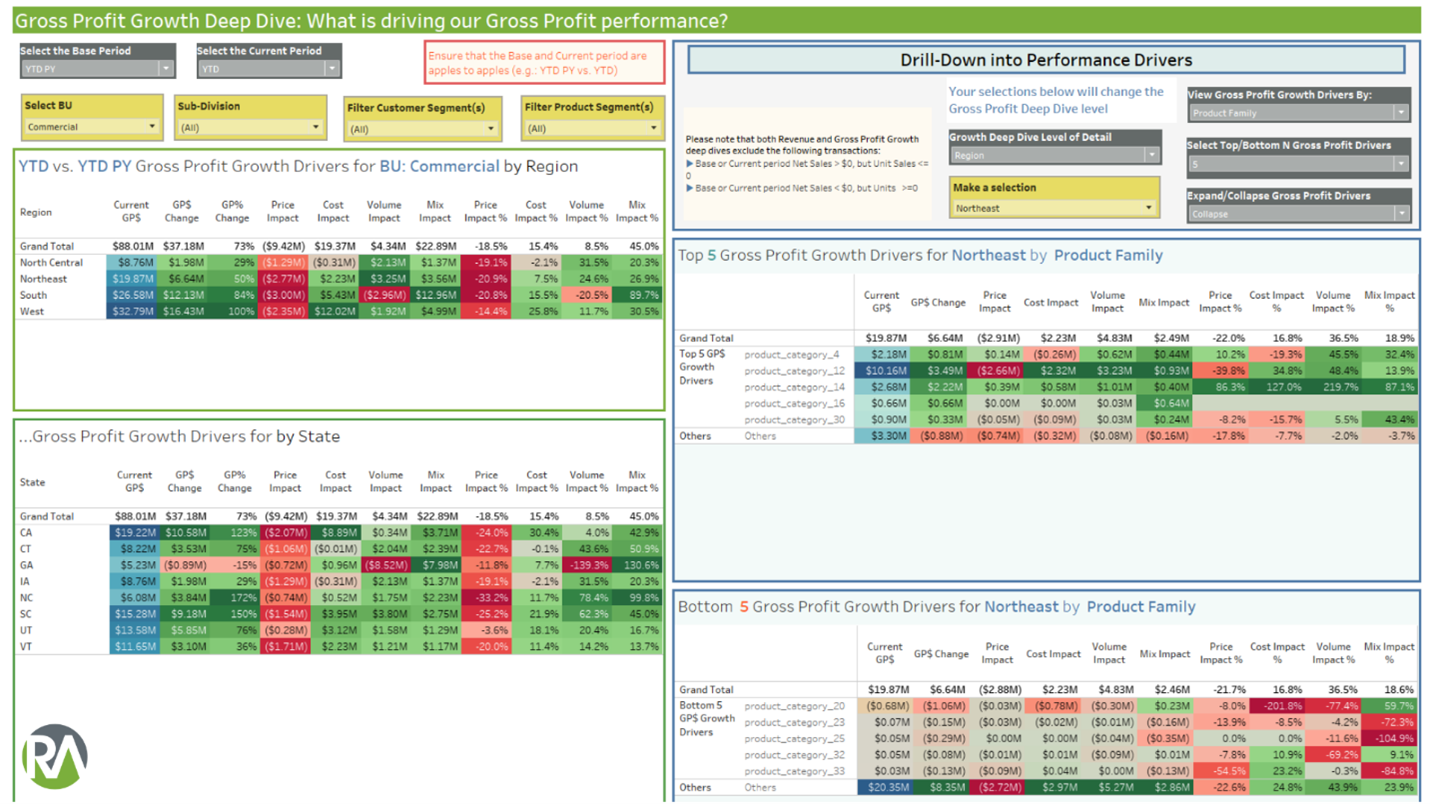

Growth Decomposition (Rate-Mix Analysis) and Optimization: systematically decomposing the critical drivers of your Revenue and Gross Profit performance into Pricing, Cost, Unit Volume, and Sales Mix drivers, and helping your Sales teams to refocus their efforts on the right products, customers or geographies and your Pricing teams to course-correct adverse pricing actions.

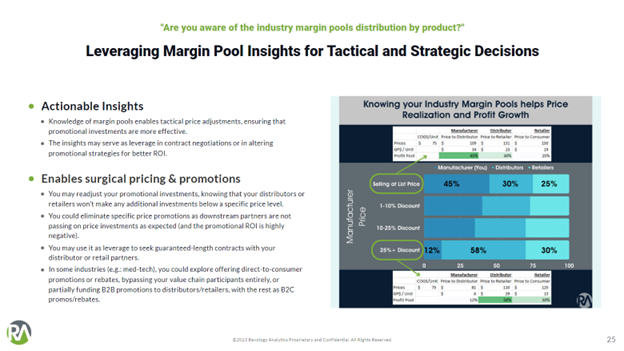

Industry Margin Pool Analysis: providing insights on the winners and losers of your industry’s value chain, helping your Pricing and Sales teams negotiate better terms or restructure rebate programs into pay-for-performance agreements. -

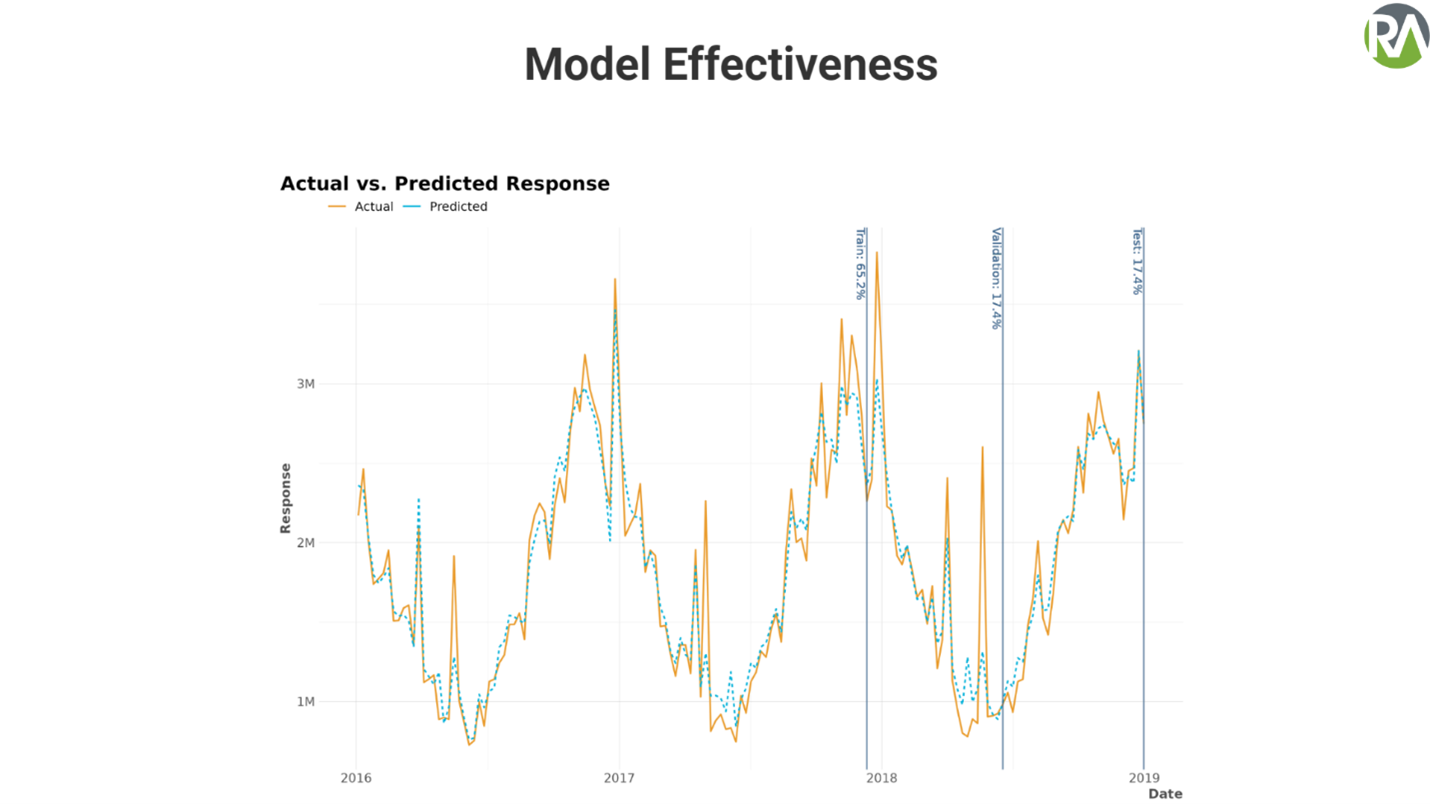

Price Elasticity Modeling: using customized statistical modeling or more advanced machine learning algorithms to help you understand the Unit Volume and Profit impact of your regular (List Price) and promotional price changes and those of your competitors. Understand price sensitivity by product for your Distributors, Retailers, and Consumers.

Dynamic Scenario Analyses: Machine Learning-enabled Volume, Revenue, and Profit scenario analyses built into your Tableau or Power BI dashboard environment for easy consumption and action by your Pricing and Sales teams.

Pricing Markdown Optimization: customized solution to manage your clearance discounting strategy to balance the need for increased liquidity and incremental profit while delivering clear Markdown Pricing Guidelines to your Pricing and Sales teams.

Dynamic Pricing capabilities: saving you thousands of working hours annually on intelligent price analytics & execution for the long tail of your product assortment, tailored to the customer’s profile and market characteristics.

Competitive Pricing Intelligence and Lead/Follow Analyses: helping your Pricing and Sales teams better understand your industry price position and anticipate competitor price moves.

Pricing Sentiment Analysis: using Natural Language Processing to help you understand what product reviews, customer service interactions, and social media chatter say about your customer price perception. -

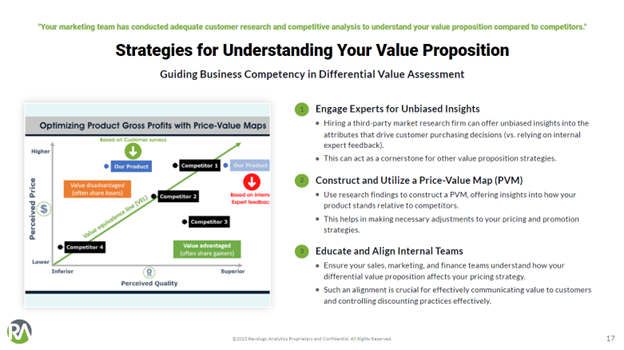

Perceived Price-Value Mapping: compared to anchor brands, monitoring your relative price and value position in the marketplace helps you evaluate potential price or product changes to drive market share.

Conjoint Analysis / Gabor Granger / Van Westendorp studies: helping your Pricing and Product teams facilitate popular customer research methods to understand pricing and feature trade-offs for new products and to complement machine learning-based price sensitivity models. -

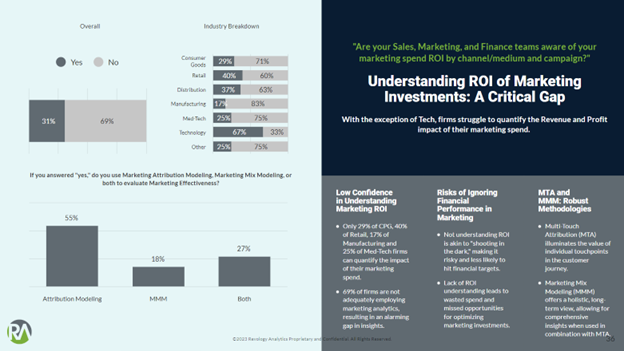

Trade Promotion Effectiveness (TPE) capabilities: providing micro- and macro-level Promotional ROIs to your Sales, Pricing, Marketing, and Category Management teams. Our TPE solutions are customized to your business, leverage harmonized internal and external/syndicated data, and are built into your Tableau or Power BI environment for easy consumption and action.

Industry Margin Pool Analysis: providing insights on the winners and losers of your industry’s value chain, helping your Pricing and Sales teams negotiate better terms or restructure Promotion & Rebate programs into pay-for-performance agreements. -

Trade Promotion Optimization (TPO) capabilities: providing you with ML-enabled simulation capabilities to predict the impact of price discounts and promotional events, including in-store merchandising support, time, and place of execution. Promotional Optimization capabilities help you generate account-specific promotional calendars that maximize a specific volume, share or profit growth objective.

TPX Vendor Assessment and Selection: the Consumer Products and Manufacturing industries have many capable software vendors specializing in industry-specific TPX (Trade Promotion Management, Effectiveness, and Optimization) solutions. For firms seeking enterprise-grade TPX software, Revology Analytics can manage the requirements analysis and gathering and the TPX vendor assessment and selection process to ensure optimal results.

Click to open

Let’s Work Together

Have a Revenue Growth Analytics pain point, a question, or a content suggestion? We would love to hear from you.

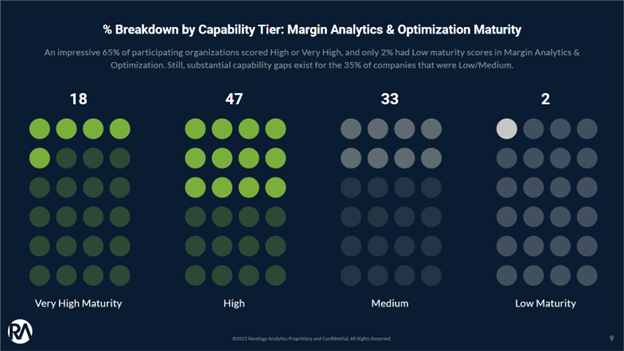

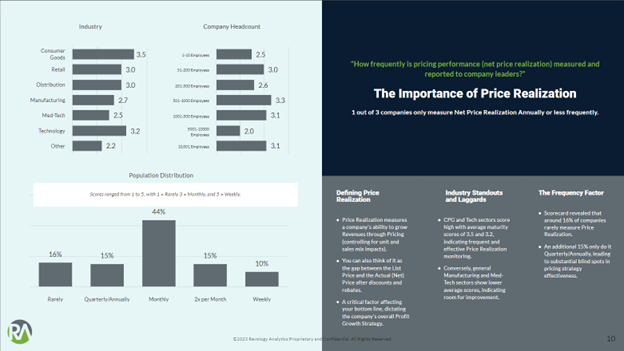

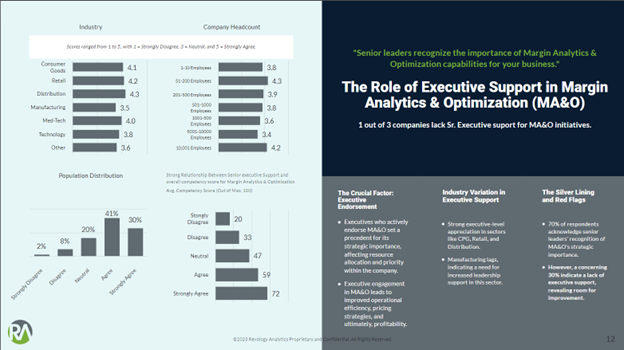

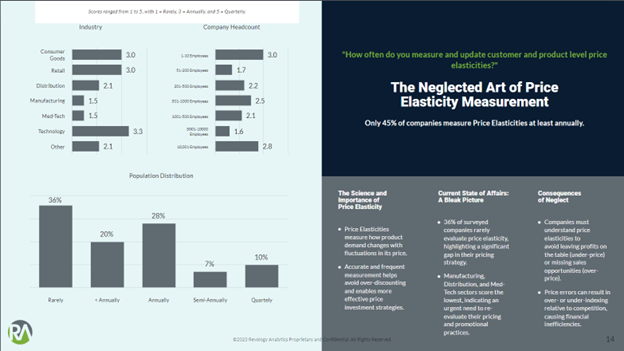

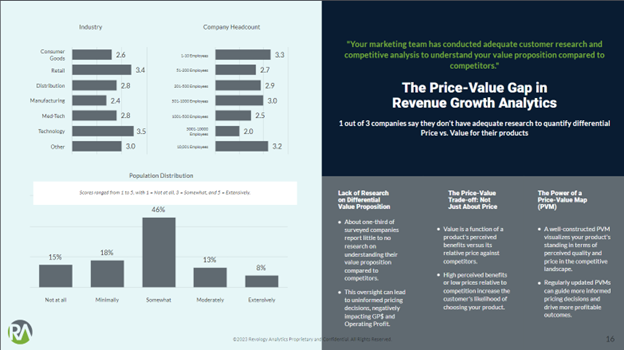

Revology's 2025 Revenue Growth Analytics (RGA) Maturity Scorecard confirms pricing is still the most powerful profit lever, but its impact is uneven and difficult for most organizations to capture. Our latest report reveals that 50% of companies remain at a 'Medium' maturity level, with significant gaps in promotion ROI and sales enablement analytics that consistently leak value. This article breaks down the four pillars of RGA and provides actionable 90-day playbooks to help leaders close the execution gap and translate price potential into realized profit.