Companies constantly seek innovative pricing strategies to maximize their profits. Value-based pricing (VBP) is a powerful strategy that aligns product or service prices with customers’ perceived value. By focusing on the benefits customers associate with a product, VBP allows businesses to capture more value and improve margins. However, accurately gauging customer perceptions and continuously refining offerings must ensure that pricing remains aligned with market expectations and consumer behavior.

In addition to value-based pricing, Price Value Mapping (PVM) is a critical tool that helps businesses visualize how their pricing and perceived value compare to competitors. It offers insights into whether their products are underpriced, overpriced, or adequately positioned. This approach benefits companies in competitive industries, such as Consumer Packaged Goods (CPG), where getting pricing right can significantly affect profitability.

Throughout this article, we’ll explore critical components of an effective pricing strategy, including customer segmentation, value proposition development, pricing optimization, and price value mapping. We’ll also review a CPG case study to highlight the importance of using independent, third-party research to assess product value and avoid costly missteps. Finally, we’ll discuss leveraging advanced analytics and market research to inform these pricing decisions and maximize profit potential.

Understanding Value-Based Pricing

Value-based pricing is a strategic approach that sets prices based on the perceived value of a product or service to customers rather than on production costs or competitor prices. This method aligns prices with the specific benefits provided to customers or the unique value a company’s products offer compared to competitors. In essence, it’s about determining a price (or a range of prices) that customers are willing to pay for the advantages and solutions offered by a product or service.

The value-based pricing strategy comprises several crucial components:

-

Customer Segmentation: Identifying and targeting specific customer groups with tailored value propositions is essential for effective implementation.

-

Value Proposition Development: Creating a clear and compelling value proposition that resonates with the target market is crucial for justifying the price point.

-

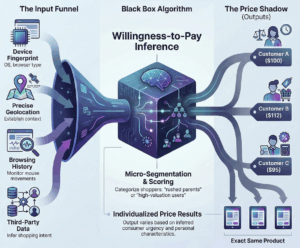

Willingness to Pay (WTP): This represents the highest price a customer will pay for a product or service. Understanding WTP is fundamental to setting optimal prices. We can measure WTP through surveys, interviews, and historical purchasing data. More advanced methods like conjoint analysis and machine learning offer deeper insights when resources allow.

-

Customer Surplus: The gap between a customer’s willingness to pay and the final price is called consumer surplus, representing the extra value the customer feels they’re getting.

-

Market Research: Conduct thorough market research, including techniques like conjoint analysis and Brand-Price Trade-Off studies, to gain insights into customer preferences and perceived value.

-

Continuous Improvement: Value-based pricing requires ongoing product enhancements and consistent market feedback to adjust to shifting customer perceptions and competitive dynamics. Regular updates to customer segmentation and pricing models ensure sustained profitability.

Differences from Cost-Plus and Competition-Based Pricing

Value-based pricing differs significantly from cost-plus and competition-based pricing strategies based on several factors:

-

Focus: While cost-plus pricing concentrates on recuperating production costs plus a standard markup, competition-based pricing employs some “smart” indexing vs. competitor prices; value-based pricing prioritizes customer perception and willingness to pay.

-

Profit Potential: Value-based pricing (VBP) allows for higher profit margins by capturing more perceived value, unlike cost-plus pricing, which may limit profitability.

-

Market Orientation: VBP is inherently customer-centric, encouraging businesses to develop offerings tailored to specific customer segments. In contrast, cost-plus and competition-based approaches focus more on internal costs or market benchmarks.

-

Flexibility: Unlike the relatively rigid formulas of cost-plus pricing, value-based pricing allows more flexibility in setting prices based on market segments and perceived value.

-

Brand Loyalty: Value-based pricing can drive stronger brand loyalty than other pricing methods by demonstrating a product’s worth and aligning price with value.

-

Complexity: Value-based pricing is generally more complex to implement, requiring extensive research and analysis, whereas cost-plus and competition-based pricing are more straightforward and linear.

Understanding these differences is crucial for businesses considering a shift to value-based pricing. While it may require more effort and resources, the potential for increased profitability and stronger customer relationships makes it an attractive option for many companies, particularly in industries where product differentiation and customer perception play significant roles in purchasing decisions.

Implementing Value-Based Pricing Strategies

Implementing value-based pricing strategies requires a deep understanding of customer segments, identification of value metrics, and design an effective pricing structure. By focusing on these critical components, businesses can maximize their profit potential and align their pricing with the value they provide to customers.

Customer Segmentation

Customer segmentation is critical to implementing Value-Based Pricing (VBP) for new products, existing products, and established customer segments. By dividing customers into distinct groups based on shared characteristics, businesses can tailor their pricing strategies to reflect the perceived value for each group. This approach maximizes revenue opportunities, whether focusing on new offerings or optimizing pricing for existing customers.

For existing products and customer segments, customer segmentation in VBP helps businesses:

-

Identify varying perceptions of value within the current customer base, ensuring that pricing adjustments reflect each segment’s evolving needs and willingness to pay.

-

Reassessing price sensitivity based on purchasing patterns enables businesses to adjust prices according to changing market dynamics or customer expectations.

-

Maximize customer lifetime value by recognizing opportunities to upsell, cross-sell, or reprice based on established customer groups’ current behaviors and preferences.

To effectively segment both new and existing customers for VBP, businesses should:

-

Leverage transactional and behavioral data: Collect detailed information about purchasing behavior, usage patterns, and post-purchase engagement. For existing products, this data reveals how customers perceive ongoing value and help identify shifts in willingness to pay.

-

Apply advanced analytics: Use clustering algorithms, RFM analysis (Recency, Frequency, Monetary), and other customer profiling techniques to segment customers into distinct groups based on value drivers, product preferences, and price sensitivity.

-

Assess segment potential: Evaluate each segment based on revenue potential, profitability, and strategic alignment with the company’s value proposition. For existing products, focus on which customer segments provide the best opportunities for price adjustments or enhanced offerings.

-

Tailor pricing strategies: Customize pricing based on each segment’s perceived value and price sensitivity. This can involve raising prices for premium segments who see high value in your offering while maintaining or lowering prices for more price-sensitive customers to maximize volume and retention.

Customer segmentation allows businesses to offer tailored pricing based on each group’s specific needs and perceived value. This increases premium segment prices while maximizing revenue from more price-sensitive customers.

Value Metric Identification

Identifying the right value metrics is critical for successfully implementing value-based pricing (VBP). A value metric is a measure that reflects how much value customers receive from a product or service. It must be easy for the company and its customers to understand and track. The value metric is the foundation for aligning the pricing model with the value delivered, directly supporting product-led growth and customer acquisition strategies.

To identify effective value metrics, consider the following:

-

Ensure the metric is easy to understand: Both customers and internal teams should quickly grasp the selected metric, enabling transparent pricing discussions and alignment on value.

-

Align the metric with customer value: The metric should reflect customers’ direct benefits from using the product or service.

-

Choose a metric that grows with usage: Ideally, the metric should increase as customers derive more value, enabling scalable pricing models.

Industry-Specific Examples of Value Metrics

-

SaaS (Software-as-a-Service): Common value metrics include the number of users, the volume of data processed, or messages sent. For instance, a project management software might charge based on the number of active users or the number of projects managed.

-

B2B Medical Devices: In the medical device industry, we can tie value metrics to patient outcomes, procedure volume, or time saved. For example, a company selling surgical robots might use the number of surgeries performed or the improvement in patient recovery time as a critical value metric. Another example could be using metrics like cost savings achieved through reduced surgery complications or reduced hospital stays.

-

B2B Industrial Manufacturing: In this sector, value metrics could be based on operational efficiencies or production output. For example, a manufacturer selling automated machinery could charge based on the percentage increase in production capacity or reductions in downtime and maintenance costs.

-

Logistics and Supply Chain Services: For B2B logistics providers, value metrics include the volume of goods transported, delivery times, or reductions in logistics costs. For example, a company providing fleet management software might use the number of vehicles tracked or fuel efficiency improvements as value metrics.

Once value metrics are identified, businesses should analyze usage patterns across customer segments to validate their choice. By evaluating the correlation between usage (or outcome) and perceived value, companies can fine-tune their pricing strategies to maximize customer satisfaction and revenue potential.

In summary, selecting the right value metric is not only about measuring product usage but also about finding the most meaningful indicator of value in your customers’ eyes. This ensures that the pricing grows with the customer’s success, creating a win-win for the business and its clients.

Price Value Mapping (PVM)

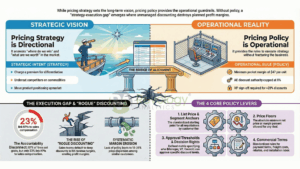

Price Value Mapping (PVM) is a strategic tool that allows companies to visualize the relationship between a product’s perceived value and its price in the marketplace. This approach helps businesses identify where their products stand relative to competitors, whether they are perceived as overpriced or underpriced based on their offered benefits.

The key to PVM is the Value Equivalence Line (VEL), which represents the market’s trade-off between price and perceived value. Products positioned above the VEL are seen as “value advantaged,” meaning they deliver higher perceived benefits for their price. Conversely, products below the VEL are “value disadvantaged” and may be perceived as overpriced relative to the benefits they provide.

By plotting products on a Price Value Map, businesses can:

-

Identify pricing opportunities: Products priced higher than their perceived value can be adjusted, while those delivering more value for a lower price may represent untapped pricing potential.

-

Optimize product positioning: Companies can assess whether their product lineup is competitively positioned in price and value.

-

Improve non-price attributes: Beyond pricing changes, companies can enhance perceived value by improving product features, branding, or customer experience to align with customer expectations.

In short, Price Value Mapping helps companies understand how consumers perceive the trade-off between price and value, empowering them to fine-tune pricing strategies, promotional tactics, and product development efforts.

CPG Case Study: The Importance of Price Value Mapping

In a Consumer Packaged Goods (CPG) case study involving a frozen dessert brand, reliance on internal expertise for Price Value Mapping led to strategic missteps that negatively impacted Gross Profits and EBITDA. The brand implemented tiered pricing for its “Signature” and “Core” products based on an internally conducted PVM and a Van Westendorp pricing study. However, the results showed a significant discrepancy between perceived value and the prices set, leading to underwhelming performance and promotional erosion.

The importance of conducting Price Value Mapping based on third-party, independent research cannot be overstated. Here’s why:

-

Unbiased Perspective: Internal teams may carry inherent biases, often leading to misjudgments in perceived value. In the CPG case, the in-house evaluation overestimated consumer willingness to pay for “Signature” products. Third-party research minimizes such biases, offering a more accurate view of how customers perceive a product’s value in relation to price.

-

Comprehensive Consumer Insights: External firms specializing in pricing research can use advanced methodologies like conjoint analysis or consumer surveys to capture nuanced consumer preferences. In this case, a detailed brand study conducted by an external agency highlighted discrepancies in perceived value between “Signature” and “Core” products, offering critical insights that were missed by the internal analysis.

-

Market Responsiveness: External research can better account for competitive dynamics and consumer shifts, helping companies avoid pricing strategies that lead to lost market share. In the case study, a third-party evaluation would have likely caught the regional differences in willingness to pay (WTP) for frozen dessert products, enabling more targeted pricing strategies.

Ultimately, third-party Price Value Mapping provides a more accurate, unbiased foundation for pricing strategy, helping companies avoid the costly mistakes that can arise from relying solely on internal resources. For CPG brands, especially in competitive categories, third-party insights are crucial for ensuring pricing strategies align with true consumer perceptions of value.

Conclusion

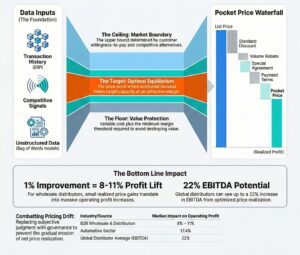

Value-based pricing profoundly influences businesses seeking to maximize their profits and strengthen customer relationships. By aligning product costs with customer-perceived value, companies can capture a larger share of the value they create, leading to increased revenue and sustainable growth. This approach requires a deep understanding of customer segments, value metrics, and effective pricing structures, enabling businesses to tailor their offerings to specific market niches and optimize their pricing strategies.

Companies should clearly communicate their value proposition for successful value-based pricing, use upselling and cross-selling opportunities, and integrate dynamic pricing techniques. This comprehensive approach allows businesses to adapt to changing market conditions while focusing on customer value. By embracing value-based pricing, companies can position themselves for long-term success and ensure they are continuously aligned with customer needs in a competitive business landscape.

To get started, businesses should prioritize customer research, invest in advanced Revenue Growth Analytics capabilities, and ensure cross-functional collaboration between pricing, marketing, and product teams.