Modern companies collect substantial amounts of data. The data captured worldwide is expected to exceed 180 zettabytes by 2025, up from 64.2 zettabytes in 2020. This proliferation of data presents a massive opportunity for companies seeking to gain valuable insights into their customers and operations.

Yet, most businesses don’t use data effectively, as up to 73% of all data goes unused. So, how can companies leverage the data they collect to boost profitability? In this article, we’ll explore how businesses, particularly in the mid-market space, or those finding themselves “data rich, but insights poor,” can gather and use data better and increase profit margins through advanced analytics.

How Companies Can Collect and Use Data Better

Many companies grapple with managing and using the vast amount of data in their data warehouses because they use outdated or inefficient commercial analytics techniques. This often results in lost revenue, and it’s estimated that organizations lose roughly $12.9 million annually due to poor data quality.

Fortunately, revenue growth analytics solutions can help. These solutions use advanced analytics, machine learning (ML), artificial intelligence (AI), and Revenue Growth Management strategies to help executives make smarter business decisions that increase profitability.

How Revenue Growth Analytics Boosts Profit Margins

Data-driven organizations are 19 times more likely to generate higher profits than their counterparts in the same industry. That said, here are several ways businesses can boost profit margins with advanced analytics:

Optimize Pricing Strategies

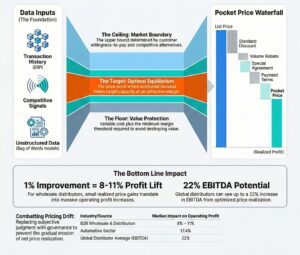

Pricing optimization is vital to the success of most organizations. Yet, many executives find it challenging to determine the optimal prices of their products or services due to a lack of reliable data, volatile market conditions, and competitive pressures, to name but a few challenges.

Advanced analytics and consumer research techniques can help businesses optimize pricing by providing valuable insights into market conditions, competitors, and customer behavior. This enables executives to make informed pricing decisions.

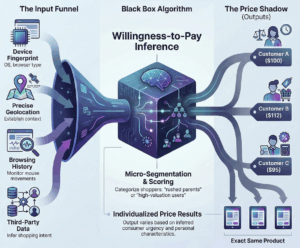

Dynamic pricing is a popular technique in Retail, Distribution, and many consumer-facing industries. It is an effective strategy that leverages machine learning to set flexible prices for products or services based on factors like demand, season, scraped competitor prices, and supply changes. This lets businesses charge more when demand increases and less when it decreases or understand competitor lead-follow pricing strategies.

Dynamic pricing is especially effective for companies with constant demand fluctuations, such as the travel industry. For instance, ride-sharing apps like Uber and Lyft leverage dynamic pricing to maximize revenue by adjusting fares depending on driver availability and trip demand.

Besides dynamic pricing, competitor-based pricing is another effective pricing technique that uses foundational pricing analytics. Unlike dynamic pricing, which focuses on consumer demand, competitor-based pricing anchors on key competitor prices.

Competitor-based pricing is ideal for businesses like retail stores that sell similar products or services. For example, Amazon’s pricing algorithm continuously monitors the pricing of competing physical and online stores (e.g., Walmart, Target) to adjust product prices.

These popular data-driven pricing techniques are just one of many ways businesses can integrate advanced analytics into their operations to optimize pricing and boost profits.

Enhance Sales and Marketing

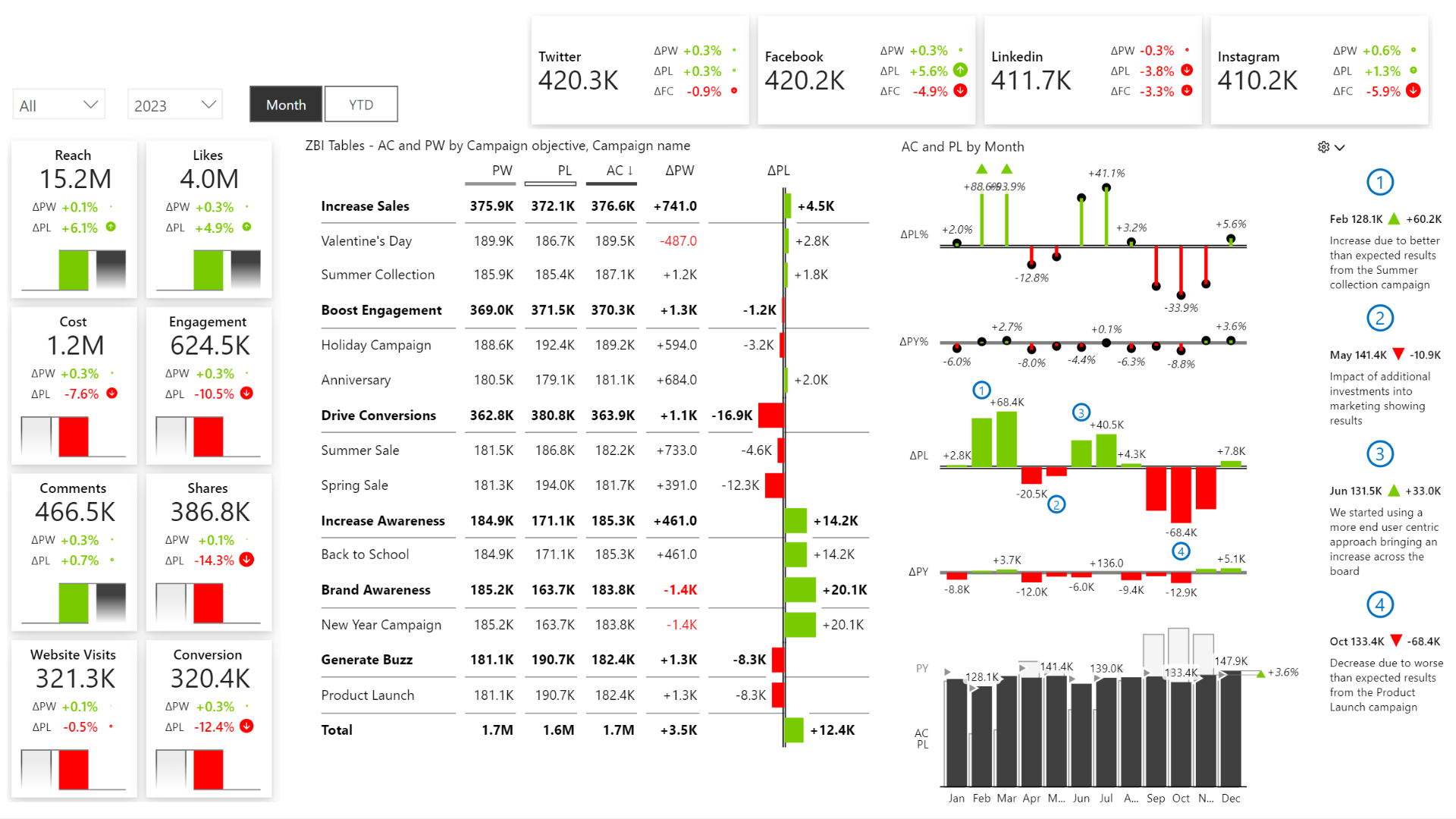

Advanced commercial analytics is integral to the success of sales and marketing teams. For sales teams, sales data can help with sales forecasting. Sales forecasting involves determining how much a product or service will sell within a specific period. By using sales data to analyze future market demand, sales teams can minimize unnecessary spending, plan sales quotas, and align those quotas with revenue expectations, resulting in higher profit margins.

Commercial analytics enables marketing teams to make better marketing decisions. For instance, analytics allows marketers to monitor the effectiveness of their campaigns by tracking metrics such as click-through rates, conversion rates, customer acquisition costs, and customer lifetime value.

The insights gained from tracking these metrics can help marketing executives create targeted marketing campaigns that resonate with audiences and select marketing channels with the highest return on investment (ROI), resulting in greater sales and higher overall profitability.

Improve the Customer Experience

Commercial analytics helps businesses determine customers’ purchase behavior, needs, and preferences. This information can help companies to learn more about their customers’ interests, allowing them to create personalized customer experiences. Since 7 out of ten consumers expect brands to provide customized experiences, this can be a huge boon for businesses seeking a competitive advantage.

Netflix is a prime example of a company that uses predictive analytics to provide customized experiences. By employing AI and ML to analyze vast amounts of customer data — like viewer searches, scrolling behavior, and past content viewed — the streaming platform offers viewers tailored content they’re likely to enjoy. As a result, over 80% of the content viewed on Netflix comes from the platform’s recommendation system.

Besides enabling organizations to personalize their interactions, business analytics can help companies reduce customer churn by up to 15% by identifying early signs of customer dissatisfaction, like decreased purchases or reduced engagement.

Since it’s up to 25 times more costly to acquire new customers than to retain existing ones, taking measures to prevent customer churn can translate into higher profitability margins.

Streamline Operations

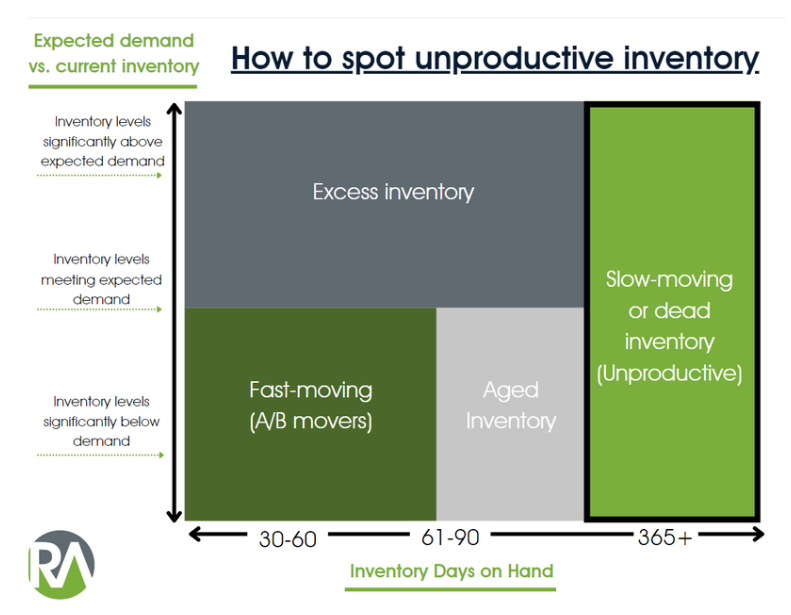

Advanced analytics can streamline various business operations, including inventory management, supply chain management, and production. Subpar inventory management is a big issue in many manufacturing and distribution companies, particularly those that have not yet invested in critical sales and inventory optimization capabilities. By gathering and analyzing vast amounts of data on these supply chain processes, companies can pinpoint ways to enhance efficiency, reduce costs, and boost productivity, improving their bottom lines.

For instance, by analyzing inventory and sales transactional data, a company can optimize inventory levels by forecasting demand and adjusting inventory accordingly. Similarly, companies can leverage advanced analytics to enhance logistics by implementing measures to reduce delivery times and transportation costs.

UPS is a perfect example of an organization that uses predictive analytics to streamline its operations. The logistics provider has optimized its delivery routes by leveraging analytics solutions to monitor traffic, weather, and other factors that may affect deliveries. This has helped UPS save about 100 million miles and 10 million gallons of fuel annually, increasing net profit.

Reduce Downtime

Certain companies, such as those in the manufacturing sector, are prone to downtime due to machinery failure. Downtime is one of manufacturers’ most significant causes of lost revenue, with an estimated $50 billion annually lost due to unplanned downtime.

Popular machine learning algorithms reduce downtime by predicting when machinery might fail, enabling manufacturers to take prompt action to avert costly downtime.

For example, one chemical manufacturer predicted an imminent pipe failure by implementing an ML-enabled program. The manufacturer implemented preventive measures to prevent the failure, reducing downtime from 10 hours to just 15 minutes. As a result, the manufacturer minimized maintenance costs by 79% and production losses by 58%, boosting operating profit.

Improve Worker Safety

Many manufacturing, construction, and transportation businesses are high-risk environments where employees are especially susceptible to injuries. Depending on the severity of the incident, workplace accidents can cause heavy losses and, in severe cases, even lead to the permanent closure of a business. It’s estimated that U.S. employers lost $167 billion in 2022 due to work injuries.

Advanced commercial analytics solutions use data to identify patterns, trends, and potential risks that may jeopardize worker safety. This allows companies to improve safety measures and prevent accidents. This safeguards employees, prevents costly injuries, and can also boost employee morale, as 97% of employees consider their physical safety at work a top priority.

Prioritize Sustainability

Contrary to popular belief that prioritizing sustainability isn’t financially viable, embracing it can boost profitability. Businesses that minimize their environmental impact experience higher profitability and revenue growth, according to a joint study by Bain & Company and EcoVadis.

By leveraging predictive analytics, businesses can optimize energy usage and reduce material wastage, minimizing their environmental impact and reducing costs.

Additionally, as more consumers consider sustainability a top priority when choosing brands, adopting sustainable business practices can make a business’s products and services more attractive to environmentally-conscious consumers.

Increase Profitability With Revenue Growth Analytics

As more businesses gather vast amounts of data, more executives are using that data to make data-driven business decisions. 44% of top executives consider data critical to decision-making, and data-driven companies vastly outperform their counterparts, growing at an average of 30% annually.

That means organizations can’t afford to ignore the data they have if they want to compete favorably with their peers. Capitalizing on their data through foundational or advanced commercial analytics capabilities and actionable insights enables executives to make smarter decisions, boost profitability, and drive growth.

Revology Analytics focuses on advanced Revenue Growth Analytics solutions to help mid-market companies in various industries — manufacturing, retail, and distribution — elevate revenue and operating profit.

Our revenue growth analytics and management experts embed themselves within organizations and collaborate with sales, marketing, and finance teams to develop custom advanced analytics capabilities and RGM strategies from concept to reality.

If you’re ready to increase profit margins through advanced analytics, contact us today to speak to one of our revenue growth analytics consultants. You can also take our free revenue growth analytics quiz to discover how to optimize your Revenue Growth Management & Analytics efforts.