Unlocking Sales Performance with Commercial

SITUATION A leading global agricultural chemical manufacturer, specializing in crop protection, sought to enhance its sales analytics capabilities to drive

Have a Revenue Growth Analytics pain point, a question, or a content suggestion?

Discover how Revology Analytics propels mid-market businesses to sustainable, profitable growth by building advanced, in-house Revenue Growth Analytics & Management (RGM) capabilities—fast.

Our senior expert-led, hands-on approach ensures you own the tools, insights, strategy and processes needed to thrive long-term.

Gain exclusive access to the latest insights from over 150 commercial leaders on the state of Revenue Growth Analytics in 2025, based on our expanded Revenue Growth Analytics Maturity Scorecard™.

Access our comprehensive advisory services, where Pricing and Revenue Growth Management transformations are at the core.

We also specialize in Sales & Marketing AI Enablement and Commercial Analytics transformations. In 90–120 days, our senior practitioners embed advanced solutions, equipping organizations with enduring, in-house growth engines that drive measurable results.

Discover how Revology Analytics propels mid-market businesses to sustainable, profitable growth by building advanced, in-house Revenue Growth Analytics & Management (RGM) capabilities—fast.

Our senior expert-led, hands-on approach ensures you own the tools, insights, strategy and processes needed to thrive long-term.

Explore Revology Analytics’ curated thought leadership on various Revenue Growth Analytics and Management topics.

Our case studies, white papers, webinars, and toolkits illuminate best practices and emerging trends. Gain actionable insights to refine your holistic Revenue Growth Management strategies and capabilities, fueling sustainable, profit-focused decisions across your organization.

Discover how Revology Analytics propels mid-market businesses to sustainable, profitable growth by building advanced, in-house Revenue Growth Analytics & Management (RGM) capabilities—fast.

Our senior expert-led, hands-on approach ensures you own the tools, insights, strategy and processes needed to thrive long-term.

Gain exclusive access to the latest insights from over 150 commercial leaders on the state of Revenue Growth Analytics in 2025, based on our expanded Revenue Growth Analytics Maturity Scorecard™.

Access our comprehensive advisory services, where Pricing and Revenue Growth Management transformations are at the core.

We also specialize in Sales & Marketing AI Enablement and Commercial Analytics transformations. In 90–120 days, our senior practitioners embed advanced solutions, equipping organizations with enduring, in-house growth engines that drive measurable results.

Discover how Revology Analytics propels mid-market businesses to sustainable, profitable growth by building advanced, in-house Revenue Growth Analytics & Management (RGM) capabilities—fast.

Our senior expert-led, hands-on approach ensures you own the tools, insights, strategy and processes needed to thrive long-term.

Explore Revology Analytics’ curated thought leadership on various Revenue Growth Analytics and Management topics.

Our case studies, white papers, webinars, and toolkits illuminate best practices and emerging trends. Gain actionable insights to refine your holistic Revenue Growth Management strategies and capabilities, fueling sustainable, profit-focused decisions across your organization.

Supercharging Portfolio Value Through Advanced Revenue Growth Analytics & Management

Leverage Revology Analytics’ integrated approach—anchored in AI, ML, and expert-led advisory—to drive sustainable, profitable growth across your Private Equity portfolio. Our rapid-impact model delivers working solutions and capabilities within 90–120 days, ensuring you internalize Pricing and Revenue Growth Management (RGM) capabilities that maximize ROI and mitigate risk in a hyper-competitive M&A environment.

As competition intensifies in Private Equity, deal origination, and post-acquisition value creation are more critical than ever. You need more than static strategy decks—you need practical, in-house capabilities that can adapt to emerging market pressures, protect margins, and deliver rapid results for Limited Partners.

At Revology Analytics, our approach centers on empowering mid-sized portfolio companies to own their revenue, pricing, and promotional decisions. Our senior experts blend decades of commercial and M&A expertise with advanced analytics tools, ensuring every engagement transfers the knowledge your portfolio teams need to thrive in pricing, growth, and operational excellence.

Rather than producing a one-off report or presentation, we:

Embed with your investment and operating teams to implement Pricing and Revenue Growth Management solutions rapidly and transparently

Achieve measurable EBITDA gains within 30-60 days

Enable you to “build, not buy” a robust Revenue Growth Management (RGM) and Pricing capability

Each portfolio company faces unique challenges—from integration hurdles and fragmented customer segments to pricing pressures and supply chain disruptions. Revology’s mission is clear: equip mid-market portfolios with advanced yet accessible Revenue Growth Analytics & Management capabilities that stimulate top-line growth, protect margins, and build internal analytics proficiency.

Opportunity Assessment & Roadmap

We begin with an in-depth audit of your target or existing portfolio companies’ pricing strategies, customer segments, and operational processes to pinpoint the highest-return opportunities.

AI/ML-Powered Insights

Our experts blend deep domain knowledge with advanced analytics and machine learning—such as price elasticity modeling, promotion and marketing investment optimization, and automated churn, upsell and cross-sell optimization—to provide an insights-driven roadmap for sustainable value creation.

Hands-On Implementation & Knowledge Transfer

We believe the most enduring improvements emerge from building in-house RGM engines. That’s why we embed with your operating teams, ensuring they can independently optimize and scale pricing, marketing, and operational capabilities long after our engagement concludes.

Guided by our core values—brutal honesty, intellectual rigor, collaborative growth, client empathy, and social responsibility—every recommendation is both strategic and immediately actionable. This hands-on, practitioner-led model, paired with extensive Private Equity and corporate experience, truly sets Revology Analytics apart.

Our Key Client Deliverables blend advanced analytics, AI/ML-driven Sales & Marketing enablement, and holistic Pricing & Revenue Growth Management strategies to deliver transformative commercial outcomes and sustained profit growth.

Generated $4 million in incremental annual operating profit with a cohesive, insights-driven pricing framework for a Private Equity–backed automotive retailer.

Delivered an eight-figure gross margin improvement via segmented, value-based pricing for a major private equity–owned footwear brand

Achieved over 3% margin gains and a 50% revenue increase on significant accounts through a comprehensive pricing overhaul at a privately owned pet products company.

Enhanced promotional ROI and increased gross profit by driving data-driven decision-making and streamlined trade investments.

Equipped finance and sales teams with real-time margin insights, fueling targeted pricing and promotional strategies and improving profitability.

SITUATION A leading global agricultural chemical manufacturer, specializing in crop protection, sought to enhance its sales analytics capabilities to drive

SITUATION A leading national auto service and tire retailer with nearly $1 billion in annual revenue and 350+ stores across

SITUATION Client BackgroundThe Client, a Private Equity owned ultra-premium fresh pet food provider, had been growing primarily through DTC.Beside premium

SITUATION Client BackgroundThe Client, a privately owned premium pet food & pet products multinational company, sells under a portfolio of

SITUATION Private Equity InvolvementOne of the world’s leading private equity firms acquired a major stake in Client co.The firm was

Private Equity success hinges on deploying scalable technologies that can quickly enhance portfolio performance. Revology Analytics seamlessly integrates predictive and prescriptive models into your Sales, Marketing, and Operational workflows—enabling rapid, precise decisions and delivering near-immediate P&L impact.

Upholding our “build, not buy” ethos, we partner with portfolio executives to implement AI/ML solutions for dynamic pricing, churn modeling, cross-selling, and cost optimization. By embedding these capabilities within your portfolio companies’ daily operations, you unlock the flexibility to continuously refine pricing, marketing, and operational strategies—leading to stronger margins, sustainable growth, and outsized returns.

Whether you’re refining due diligence, orchestrating a post-acquisition integration, or optimizing an existing portfolio asset, Revology Analytics is your partner for building and preserving portfolio value. Our offerings unify pricing, promotions, and marketing analytics—augmented by syndicated data and AI/ML—to seize every growth opportunity.

By combining senior practitioner-led guidance with advanced analytics, we enable your mid-market portfolio investments to compete at an enterprise level. We exist to help you build, not buy your future—so by the end of our engagement, you’ll have:

Ready to transform your portfolio companies for higher ROI?

Contact us to learn how Revology can deliver rapid, lasting impact for your Private Equity investments.

Proven expertise in pricing strategy, elasticity modeling, margin analytics, and dynamic pricing deployment.

Machine learning–powered solutions for customer segmentation, churn modeling, cross-sell optimization, and marketing mix modeling.

Building best-in-class data infrastructures, automating forecasting, and deploying AI-driven insights across finance, sales, and operations.

By marrying these specialties to your M&A strategy, we help identify high-potential acquisition targets, streamline due diligence, and accelerate post-close revenue growth—all within the demanding timelines of Private Equity.

Partner with Revology Analytics to energize value creation across the deal lifecycle—from initial due diligence to post-acquisition revenue optimization. We’re committed to embedding data-driven insights, operational efficiency, and unstoppable growth within your portfolio.

Have a Revenue Growth Analytics pain point, a question, or a content suggestion?

The Hurt Hub@Davidson

210 Delburg St, Davidson, NC 28036, United States

+1 803-701-9243

We would love to hear from you.

Centered on proven best practices, Revology Analytics® provides Revenue Growth Analytics advisory services and thought leadership, driving profitable revenue growth for middle-market companies.

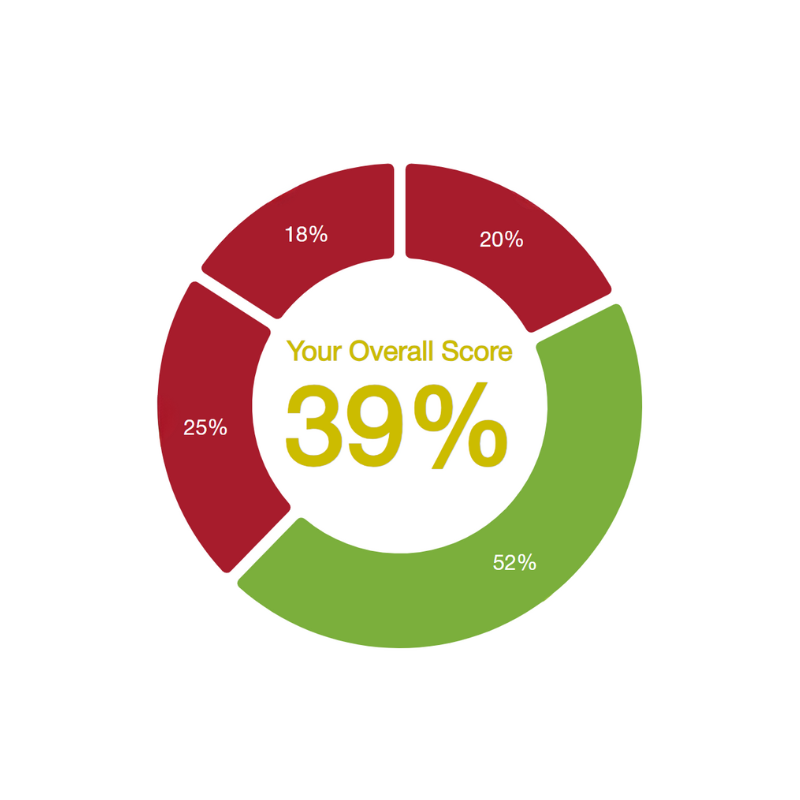

Over 225 companies took our scorecard to improve their Revenue Growth Analytics & Management capabilities.

Copyright@2026 Revology Analytics LLC